To Issue 152

Citation: “Interview with Doug Bryans of Bryllan & John Merhige of Credence MedSystems”. ONdrugDelivery, Issue 152 (Oct 2023), pp 110–114.

Douglas Bryans and John Merhige engage in a lively and wide-ranging discussion with ONdrugDelivery’s Guy Furness about the changing needs of drug developers around novel dual-chamber and ready-to-use drug delivery devices, capacity and the delivery of complete solutions from CDMOs and device developers, anchored around the recently announced partnership between Credence MedSystems and Bryllan to provide these critical services.

“There is a need to simplify the delivery of complex drugs that

require mixing at the time of use.”

Q To begin with, could you give us a brief overview of Bryllan and Credence MedSystems, and introduce us to the partnership between the two companies?

DB Certainly, Bryllan is a fill-finish contract manufacturer, and we have been in business about 10 years. Our primary focus is the fill-finish of complex drug-device combination products, and we have both small-scale clinical capacity and commercial-scale capacity. Our focus is working with innovators and developers to meet the needs of new drug development opportunities and supporting capacity at clinical and commercial scale, for future drug developments.

JM Credence MedSystems is an inventor, developer and supplier of injection devices. We work very hard to see where the market needs are, oftentimes focusing on broad-based market needs and sometimes on bespoke needs for specific customers. We find solutions and commercialise them. We’ve just passed our 10-year anniversary and our focus throughout has been very much on injectable drug delivery.

With respect to our partnership, it’s a collaboration that is fundamentally based on two things – an understanding of where the market is going for ready-to-use and ready-to-mix drug products, and a shared philosophy on providing pharma what it needs in order to satisfy those trends. There’s no exclusivity attached to the collaboration. Rather, we simply focus together on bringing pharma companies what they need from a drug delivery device perspective and what they need from a CDMO (contract design and manufacturing organisation) fill-finish perspective. Offering both together is becoming increasingly important, as we will discuss in more detail.

Q You mentioned ready-to-use and ready-to-mix drug products. What are the drivers behind the development of these types of drug and device products?

JM There is a need to simplify the delivery of complex drugs that require mixing at the time of use. Alongside that, the delivery of medications is currently being increasingly transferred out of formal healthcare settings. Oftentimes, that’s self-administration, or administration by a loved one, but the important point is that these are non-professionals, and sometimes they’re compromised patients with physical and cognitive limitations. So, the user population is more naive, but the medication formulations aren’t getting more simple, they’re getting more complex, right?

It can be extremely difficult, or even impossible, to get liquid stable solutions. Even if it is possible, it can take years of formulation work. This means that the drug needs to be reconstituted or resuspended at the time of use just prior to injection. And that’s just the start; sometimes you’re looking to combine two liquids that need to be kept separate during storage because you want to avoid co-formulation or because there’s some type of reactivity between the liquids.

“The more capacity available, the faster some of these changes in philosophy at the drug development stage will take place.”

You can see how the drug delivery challenges are growing but the user population is more naive. It’s all of our responsibility to further simplify the delivery of these complex drug products.

DB I agree on that. Additionally, some of the other business cases that are being developed are associated with a way to reduce cost at the hospital level by eliminating the compounding process and creating a drug-device combination that is ready-to-use or ready-to-mix, which also eliminates a number of errors and potential risks involved in the process of compounding in the pharmacies.

It also frees up nurse and healthcare provider time to spend on care rather than preparation. Policy drivers in different countries are supporting changes to the way in which certain diseases are treated, which are also tending towards better delivery of medication.

I think that the lack of fill-finish capacity is also inhibiting the speed at which some of this activity can be done. That is a key focus of the partnership between Bryllan and Credence. The more capacity available, the faster some of these changes in philosophy at the drug development stage will take place.

JM Doug is 100% right. This is not just an at-home phenomenon, it is also important in formal healthcare settings. Consider a scenario where you’ve got a conventional vial presentation where the user needs to take syringes and needles, and go back and forth between a diluent vial and a lyophilised cake vial, for example. Upgrade that to a dual chamber, ready-to-mix or ready-to-use scenario and you are eliminating potential for dosing error, contamination and exposure to highly potent drug products. Beyond that, you’re reducing risk of needlestick injury, you’re speeding up time of preparation, you’re eliminating overfill requirements, all of which have a direct or indirect impact on cost of ownership and safety to whomever is doing the preparation.

DB Something else that’s come up recently across several regions, including numerous countries in Europe, is related to drug sustainability and the evolution of potential green approaches to handling drug development. One of the business cases was the cost of disposal of all the consumables involved in using traditional liquid drugs versus having a ready-to-use product where you eliminate multiple syringes, needles and other materials that not only have to be purchased, but also have to be disposed of. There’s a significant cost of disposal and long-term treatment of those types of materials which, ultimately, have to be incinerated or put into landfill. I saw one business case recently that said ready-to-use is justified on that basis alone, even without taking into consideration the other substantial benefits that we’ve discussed so far.

JM And there’s also the impact on the supply chain. The conventional approach includes very complex kits requiring multiple vials, syringes, needles, swabs and secondary packaging. With dual chamber and other ready-to-use systems, all of that gets simplified dramatically.

“It’s not just understanding that a particular dosage form costs X, but understanding the cost of the supply chain to deliver that in a healthcare setting.”

Q I’d like to expand a bit on the point you raised about shifting policies influencing the direction of drug and delivery device development. Can you tell our readers more about how payers and reimbursement models are having an impact on the industry at present?

DB This is a key factor in the business cases that are driving companies across different markets to move towards finding ready-to-use, ready-to-mix product solutions.

Obviously, in social-funded medicine, cost drivers are becoming more critical as patient populations get older overall; the tax base is always under pressure, and it will require wholesale operating changes to make significant cost savings. Moving significant pipelines of products to ready-to-use or ready-to-mix is one strategy that would offer a significant cost reduction – it’s formulation time, it’s compounding time, it’s all of the items that we’ve mentioned that have to be purchased and disposed of, all of which could be eliminated to a significant degree if a large number of products were available in a ready-to-use, ready-to-mix format.

In insurance-based systems, policy changes are starting to allow for reimbursements of more at-home healthcare. Reimbursements of new product developments are driving innovation on where drug delivery can take place, facilitating the move from hospital to home and informal settings, which John spoke about earlier. Those are having a significant impact on the decision-making around which products should be developed and where those products should be delivered.

JM Building on what Doug said, covid-19, alongside all of its tragedies, opened up some opportunities within the healthcare industry. You had a period where the capacity in the healthcare setting was minimised, the number of sick patients was increasing and something had to be done. So, at that time, the Centers for Medicare and Medicaid Services funded ‘acute hospital care at home’, more commonly known as Hospital-At-Home here in the US, which has just been extended through 2024. And logic would say that, once it’s in place, it’s going to stay in place because you’re increasing your capacity for acute care, right?

I’m not talking about chronic self-injections, here. This is acute care, and you’re increasing your capacity by making the world your ‘hospital’ setting, you’re dramatically lowering your costs by being outside of that formal healthcare setting. For many patients, although certainly not for all, it’s a much better situation. A healthcare provider comes to them as needed to care for them, monitor them and administer their medications – it’s game changing.

However, you also have to realise that, in some cases, these are probably less experienced healthcare professionals, and they don’t have the structure of a hospital around them. So, all of those considerations around simplifying delivery are really relevant here. Furthermore, the industry’s push to change IV (intravenous) therapies to SC (subcutaneous) therapies is a big part of this as well.

DB Just one other point on the business cases. It’s understanding the total cost of delivering a medication that’s important. It’s not just understanding that a particular dosage form costs X, but understanding the cost of the supply chain to deliver that in a healthcare setting. Unfortunately, this isn’t always understood by the models and financial structures we currently have in place. For example, in the US, the GPOs (group purchasing organisations) buy the medications, but the GPOs don’t understand the cost of delivering them when it comes to compounding, and the time on ward and the nurse’s time on top of that. On the other hand, the C-suite understands that, but only sees a cost of goods item when it comes to the GPOs. Those connections have to be made to really understand the total cost of a medication.

Q Can you give our readers your more detailed thoughts on the current state of global fill-finish services and capacity?

DB Broadly, global fill-finish capacity is legacy and reflects the developments of the last 50 years. Most products are still filled into glass vials during development and still filled into glass vials at commercial scale, and the capacity reflects that. Obviously, over the last 20 years, we’ve seen a move towards things like prefilled syringes, more IV bags, but fill-finish capacity is limited to a few big players. And most of those products are simple, terminally sterilised. There’s not a lot of capacity for aseptic bags and or for complex biologics or toxic products that, typically, have to be aseptically filled.

For the most part, CDMOs have been slow or are slow to respond to some of the development demands coming from the pharmaceutical industry. Also, a lot of those pharma developers do not have their own fill-finish capacity, they are virtual companies with no in-house capacity, or limited capabilities, that are looking to outsource all of that work. So, the speed at which the move to ready-to-use and ready-to-mix can go is being limited by the movement of the supply chain; both for multi-chamber components and the fill-finish capacity to take the product from clinical scale through to commercial scale.

There is a “chicken and egg” element to this. Industry feedback is telling us that, if the capacity was in place, there would be a mindset shift in formulation product development within pharma companies, and things would move in this direction much faster. This is a crucial point, and the partnership between Bryllan and Credence really represents an effort to start to move the industry in that way. We feel very confident that building a capacity model from small scale to large scale will be a key enabler for moving a number of products in this direction globally.

JM You’ve got a chasm, right? On one side of it is significant and growing demand for dual chamber delivery, or ready-to-use and ready-to-mix products more broadly (Figure 1). Then on the other, we’re saying fill-finish and capacity is a massively important aspect. The challenge is to bridge that chasm – it’s by bringing device technology and production capacity together that you get to a solution, which is a full offering to pharma. They want to move forward and want to believe that there is a very clear path from preclinical to clinical to commercial.

Figure 1: Credence MedSystems’ Dual Chamber syringe.

Between a device manufacturer and a fill-finish CDMO, we’ve got all the elements in place, it’s a checked box. So, the next step is creating a very clear, very executable vision for implementing the commercial scale manufacturing. And the closer these two sides come to each other, it’s almost like two magnets – once they get close enough together, they start pulling towards each other. And that’s happening, it’s not done yet, but it’s happening.

“Developers are now interested in looking at ways to bring new technology to create high-speed filling of bulk sterile powders.”

DB A few years ago, there was the odd company looking at dual chamber or ready-to-use, ready-to-mix, but that wasn’t in itself an incentive for someone like Bryllan or Credence to move at the speed we’re currently moving. But, today, the business cases are coming from the global pharmaceutical and biotech industry, which is developing new chemical entities right into new delivery systems.

The drivers for cost reduction are global, and, combined, there’s a real emphasis to move capacity in this direction; enough that it makes sense for Bryllan to invest more in innovative fill-finish capacity than the last 50 years have incentivised, looking to support the development and platform fill-finish needs, along with providing a landing ground, for Credence as it develops innovative technologies for syringe delivery.

Looking at other driving factors, there are two major things that have happened at the same time, one of which is the growth of personalised medicine, which has reduced the production of mass medication.Following this, batch size changes have changed the development and scale of capacity. Large filling lines are no longer economical if batch sizes have come down by 50% and more.

The other major change is that you now have multiple forms to deliver medication – vials, bags, mixing systems, wearable devices, dual chamber, ready-to-mix syringes, ready-to-mix bags, ready-to-mix vials and more. However, they are all growing to such a degree that it not only requires innovation on the development of the device, but also on the innovation and implementation of the capacity to produce at commercial scale.

Q What would you say is the right capacity to support future drug device innovation and facilitate the commercial supply chain at the appropriate level?

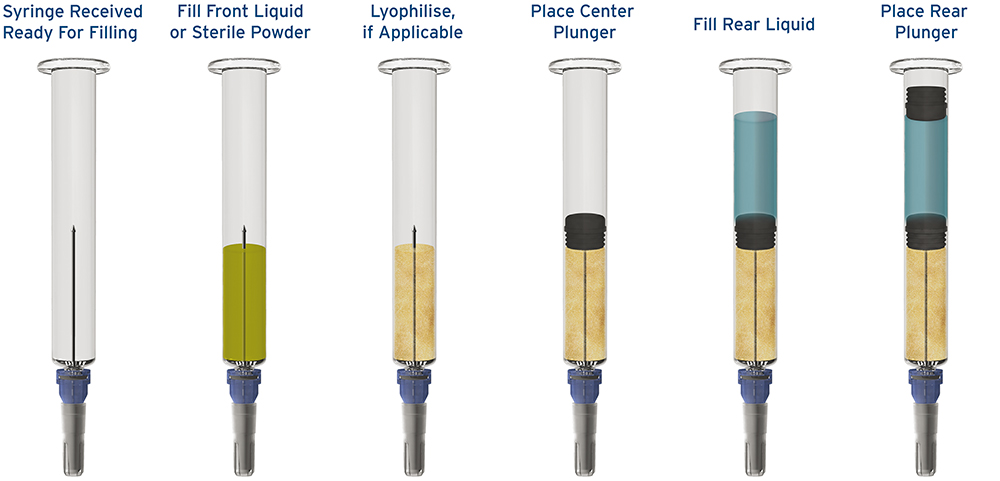

DB The covid-19 pandemic really highlighted the lack of fill-finish capacity in the US. The response to that is to look to onshore more of the supply chain, including fill-finish capacity; there is a clear need to onshore specific types of capacity for preparedness for the future, including pandemic concerns. But that cannot be the only type of capacity built domestically in the US. We also need to focus on the capacity required to build the supply chains for ready-to-use, ready to mix and dual chamber products (Figure 2), including the scope for innovation and new technologies for creating sterile powder.

Figure 2: The fill-finish process for a prefilled dual chamber syringe.

There have been numerous techniques available for several years, many of them niche ones that haven’t really been progressed, but developers are now interested in looking at ways to bring new technology to create high-speed filling of bulk sterile powders. Of course, powder filling has been done before, but typically not directly into a vial, a syringe or a bag, and those are the demands that are now being placed on CDMOs if they are going to support customer developments and commercial demands. And so Bryllan is focused on supporting numerous partners to bring those technologies onshore to provide that complete supply chain.

JM It’s a very logical approach. So, today, for a lyophilised drug product, whether it’s in a vial or a prefilled syringe, the lyophilisation process is the long pole in the tent, the bottleneck. It’s measured in hours, or even days – a two-to-three-day cycle time, for instance, isn’t uncommon. You’ve got these massive capital expenditures that are sitting there for two to three days to produce a batch. If you go into a company that does lyophilisation of vials, it almost looks like a solar panel farm, right? They’re just lined up because you’re trying to get as many units in them as possible because it takes so long to go through.

What Doug’s talking about here is probably the most economic and capacity-efficient approach to commercialising what we refer to as a lyo-liquid dual chamber syringe or bag. The way this works is that the lyophilisation happens offline, and then the processes that need to be sterile, such as powder filling, happen in-line and your overall process becomes way more efficient. Now there’s development work to be done, and the industry has been looking at this for a long time, but I believe it’s the most efficient way to implement commercial-scale dry liquid fill.

We’re doing the same thing on the device side. Right now, we’re launching what we call our Flexible Clinical Manufacturing Line, which will have modest volumes across a broad array of single chamber and dual chamber products and be able to produce products for human use. And that’s to feed all these programmes that are in clinical and earlier developmental stages. The next step is investment in the commercial-scale line, which will take our capacity from half a million units per year capacity to 50 million units per year.So, it’s the same strategy that Doug’s talking about being implemented on the fill-finish side is also being implemented on the device manufacturing side.

Q To wrap up, can you offer our readers your thoughts on what it takes to offer pharma a complete solution, from device development to clinical-scale production to commercial-scale production?

JM It comes back to the first thing we said, which is that we need to meet pharma where they are and provide what they need to satisfy the macro drivers in healthcare. Some pharma have a sufficient resource and capability set such that what they’re really looking for is a device company to supply them with the device and a fill-finish company to do the fill-finish and maybe some formulation work. That’s the classic model of a CDMO providing a service and a device company supplying a drug-device combination.

But there’s this whole other world that includes companies from large pharma to innovative biotech start-ups that can’t or don’t want to do that work. Whether because of capacity constraints, personnel bandwidth constraints or resource expertise, they want a full regulatory submission package as the deliverable. They see this as a powerful and efficient method of differentiating their product lines, be it for specialty generics or innovative new molecules. They want the whole package delivered to them, right up to regulatory submission.

That’s where we, with Bryllan and with others, come in to fill that need. We can work together with pharma to identify where the drug product needs are, where the gaps in their portfolio are, then we can identify the appropriate development pathway, the appropriate milestones, the appropriate funding mechanisms, which can be a mix of upfront and milestone driven. And we can deliver a full product package for pharma to submit to regulators.

This approach really seems to be resonating with a variety of different pharma segments. One in particular is the traditional generic suppliers that are trying to move to more value-add and more of a specialty generic offering where the device or the formulation brings differentiation.

DB From the CDMO point of view, the way to add to the current model is proactive investment in capacity rather than reactive investment once the customer is on board. We need to move on from the attitude of “Let’s wait for the customer to sign on, then we’ll start to do something”. If we’re going to make a stepwise change, there has to be a different risk tolerance to investment in capacity at the CDMO level.

And there needs to be potential for customers to invest in capacity specific to a need. For example, at Bryllan, we have one customer who is investing in a fill-finish bag line to do a triple chamber bag because they want to take control of their own commercial volume and commercial destiny. Going forwards, I see these models becoming more of a discussion point and there being more willingness on both sides to help to drive product development and future commercial capacities forward.

JM This entire discussion is around collaboration within the supply chain to provide pharma manufacturers a suite of products and services that are needed to help them address new requirements evolving from emerging trends in healthcare. Drug technologies are more complex and are often being delivered by less-experienced users, so the need exists to simplify the delivery of these drugs, while improving the safety of doing so. Successful commercialisation of dual chamber and ready-to-mix/ready-to-use solutions requires more than just a great device and more than just great filling capability. Pharma manufacturers need delivery device companies and CDMO companies working together to provide the full system.

To find out more about Credence MedSystems, visit: www.credencemed.com.

To find out more about Bryllan, visit: www.bryllan.com.