To Issue 175

Citation: Richard P, “Self-Injection Device Manufacturing in a Dynamic World”. ONdrugDelivery, Issue 175 (Jul 2025), pp 8–12.

Philipp Richard scrutinises the efficient production of self-injection devices in the pharma industry and describes Ypsomed’s own platforms for developing these devices, highlighting the need to be adaptable and resilient to the rapidly evolving world of drug development. He provides valuable insights into the ways in which the flexible manufacture of self-injection devices might be achieved.

THE EVOLUTION OF SELF-INJECTION DEVICES

Fifty years ago, the advent of biotechnology heralded a new era of novel drugs. With complex molecules unsuitable for oral administration, injection-based systems were required to deliver the drug either directly into the bloodstream or under the skin. The latter route, subcutaneous injection, gave rise to a field of self-injection devices that enable patients to safely and conveniently take the drug themselves.

To begin with, the majority of these devices delivered insulin and were, with designs inspired by ballpoint pens, devices that used prefilled cartridges containing the drug. With the advent of the prefilled syringe (PFS), self-injection entered the scene for the delivery of single-fixed doses, driven by the need to administer non-preserved formulations of monoclonal antibodies.

At first, reusable systems prevailed and the overall need for self-injection devices was comparably low due to their long service life and limited overall demand. Back then, these devices were considered functional secondary packaging, manufactured mostly by big pharma for its own needs. Outside of this, only a limited number of specialised suppliers, such as Ypsomed, offered design and manufacturing capabilities. At this stage, regulations were more lenient, and the focus was on simple solutions that could elevate the established standard of care (i.e. vial and syringes) in terms of user-friendliness and accuracy.

FROM REUSABLE SYSTEMS TO PREFILLED DEVICES

As the market evolved in the early 2000s, usability became an important design consideration. Convenient, prefilled pen injectors were rolled out to serve the needs of an exploding population of insulin-dependent Type 2 diabetics with second-generation synthetic insulins. In the same period, the first autoinjectors for the administration of TNF-α inhibiting monoclonal antibodies were successfully launched and sold in increasing numbers.

“THE STRONG GROWTH IN THIS PERIOD HIGHLIGHTED THE LIMITS AND RISKS IN THE EXISTING SETUP OF SUPPLY CHAINS FOR DEVICES THAT WERE SUPPORTING MULTI-BILLION DRUG FRANCHISES.”

This shift from reusable systems, regulated as medical devices, to ever-growing numbers of prefilled products, regulated as combination or medicinal products, also required new regulatory capabilities in the pharma industry. The strong growth in this period highlighted the limits and risks in the existing setup of supply chains for devices that were supporting multi-billion drug franchises. Big pharma started to either build up massive manufacturing capacity in-house or started collaborating with a growing network of contract manufacturers that would operate multiple manufacturing lines for the same product.

At the same time, it became apparent that the traditional approach towards development, industrialisation and manufacturing of self-injection devices – that is, the deployment of a bespoke device for each drug – was not fast enough to ensure desired time to market, was too expensive, and also too risky given the rate of attrition in drug development pipelines.

THE SHIFT TO PLATFORM-BASED DEVELOPMENT

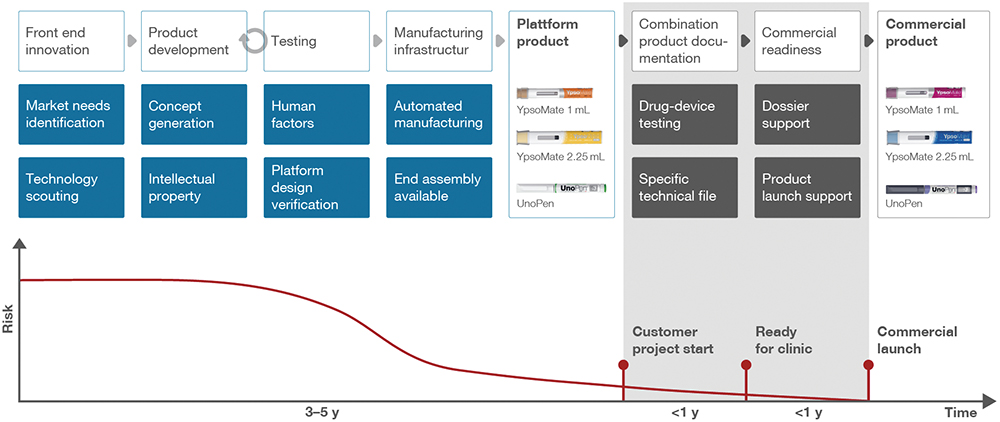

Based on these circumstances, Ypsomed moved rapidly to develop its platform approach, which it introduced in 2010. The platform approach offers pre-developed devices that are ready for production using a flexible and shared manufacturing setup (Figure 1). With such platforms, the main drawbacks of the traditional approach could be mitigated, and time to clinic, as well as time to market, for any drug in a self-injection device could be considerably lowered at a fraction of the cost of bespoke development. Thus, the barriers to accessing state-of-the-art self-injection devices were lowered, which also opened new possibilities for the rising biosimilars industry.

Figure 1: Ypsomed’s platform strategy accelerates time-to-market, leveraging modular autoinjector components that are adaptable for diverse drugs and patient needs.

Nowadays, platforms are an established business and manufacturing model that have given rise to a networked industry of consultancies, design companies, device companies, manufacturing equipment suppliers, primary container companies and contract manufacturing organisations.

Yet, challenges remain, such as manufacturing flexibility, speed of scale-up and continuity of supply, calling for specific solutions at various levels. This is because at the end of the day, as has been the case ever since the approval of the first recombinant insulin by the US FDA in 1982, patients need their pharmacy to have the drugs they need in stock at all times.

ADDRESSING FLEXIBILITY AND SCALE-UP CHALLENGES

In consumer goods and cars, the “batch size of one” or fully customised product, has become the holy grail and has shaped expectations. However, manufacturing pharmaceuticals is historically a volume business, driven by batch production and large upfront investments in highly specialised facilities dedicated to a single asset. The same applies to the manufacture of medical devices, which ask for tooling and assembly equipment with long lead times.

Both factors work against flexible manufacturing (i.e. building different products or product variants in variable lot sizes on the same production line). While adjusting lot sizes is straightforward in principle, it might raise questions about economic viability if the ratio of lot sizes to the output of a line is low. So, the volume flexibility needed for clinical studies (e.g. low volumes of several product variants for different dose strengths) must be supported by equipment with suitably high flexibility and limited output.

More complex, however, is the sort of flexibility that enables the manufacture of several product variants on the same highly automated production line. This flexibility must be built into the design of the delivery device by considering a parameter space that covers all potential drugs and by designing it for a broad user population with a range of properties. The device must then be configured from components that are part of that product’s platform and manufactured on this flexible line. Robust processes and a comprehensive control strategy interlinked with downstream operations can ensure that every production campaign yields the desired product variant with the correct specifications.

Speed of scale-up has been a long-standing industry concern that could often be addressed with moderate risk-taking by building up an initial capacity based on vetted market assumptions. Even if a manufacturing line for a self-injection device is a complex procurement item that takes, depending on its output, between 1.5 and 3 years to get up and running, staggering the scale-up over time as demand evolves has worked comparably well in the past.

“SCALE-UP NEEDS TO TAKE PLACE MUCH MORE RAPIDLY AND DEMANDS A BOLDER APPROACH.”

However, as the dynamic growth driven by mass uptake of obesity treatments has shown, this is no longer fast enough. Scale-up needs to take place much more rapidly and demands a bolder approach (i.e. earlier and greater capital layout even in light of uncertain market uptake of the drug).

At Ypsomed, the thinking has recently been to challenge the assumption that fast-running assembly lines have to be “one trick ponies” geared to manufacture a single product variant. Instead, Ypsomed has considered a more flexible setup that allows the retooling of fast-running lines in acceptable timeframes for other products, thus reducing the risks of building capacity for one single asset (Figure 2). This thought process was driven by different players in the value network and highlights the need for close collaboration within the industry, which has shaped the way that Ypsomed engages with its extended manufacturing ecosystem.

Figure 2: Ypsomed’s platform approach minimises risk, accelerates time-to-market and scales globally – from clinical trials to commercial launch.

Figure 3: Ypsomed has over 40 years of experience building strategic partnerships across the global combination product ecosystem.

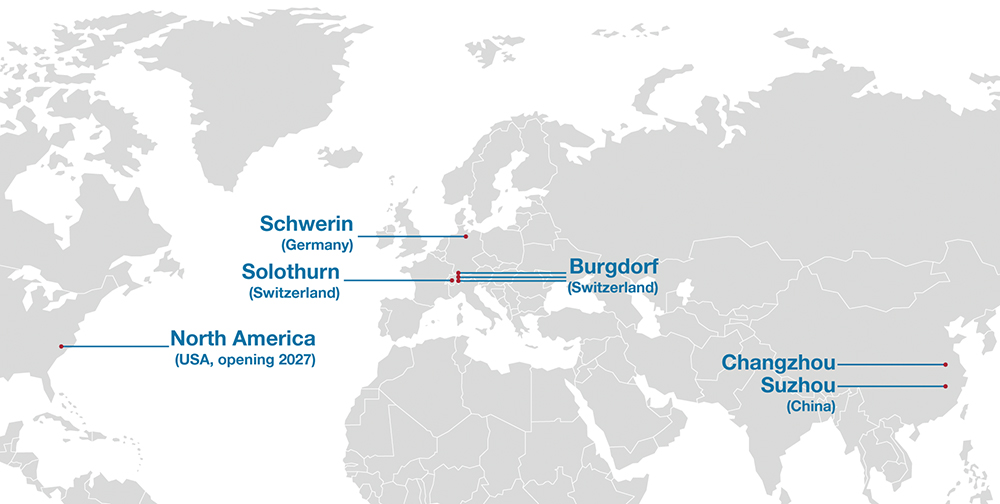

Over the past few decades, a strategic network of partners has emerged, including primary container manufacturers, fill-finish providers and final assembly CMOs. These long-standing partnerships extend across North America, Europe and Asia, supporting both clinical and commercial supply. By working with trusted partners that share aligned quality and performance standards, Ypsomed can complement its own manufacturing footprint with additional capacity and flexibility, ultimately helping to reduce timelines and manage complexity in the development and delivery of combination products (Figure 3).

BUILDING SUPPLY CHAIN RESILIENCE IN A VOLATILE WORLD

While flexible designs and fast, adjustable lines are necessary to address today’s supply chain needs for self-injection devices, they are still by no means sufficient. The recent pandemic, the repercussions of the war in Ukraine and the surge in demand due to current obesity treatments have highlighted the need for robust supply chains that can cope with rapid change in demand, temporary disruption and shortage of raw materials, components and equipment.

Setting up a resilient and efficient supply chain comes down to balancing redundancy and overcapacity against demand and managing multiple sources of raw materials and components. It can, as a pharma company, be tempting to ask for a fully redundant, geographically distributed supply chain based on equipment from multiple vendors using materials and components from multiple sources.

“GEOGRAPHIC DISTRIBUTION AND EQUIPMENT DIVERSITY CAN BE REASONABLY ACHIEVED WHILE ENSURING THAT PROCESSES CAN STILL BE EASILY TRANSFERRED.”

However, this approach can be unnecessary and rarely yields an economically viable solution for a self injection device. Ypsomed relies on assembly lines with different capacities, usually from different vendors that are located at different sites. In this way, geographic distribution and equipment diversity can be reasonably achieved while ensuring that processes can still be easily transferred, for example, from Ypsomed’s leading sites in Switzerland to its new operations in Germany, China and the United States (Figure 4).

Figure 4: Ypsomed’s manufacturing sites are strategically located to ensure global access and supply chain resilience.

For single parts, running multiple tools and having sets of pre-qualified cores and cavities ready has been an established approach in the industry for a long time. Instead, the focus is on redundancy rather than diversity, as Ypsomed builds a large share of its tools in its own facility in Burgdorf (Switzerland) and soon in Solothurn (Switzerland).

Multiple sources for raw materials and components are much more challenging to put in place. This is especially true for resins, as the purchased quantities are comparably small by global standards and medical grades are not readily available for all resin types. More often than not, it has to be accepted that, at the raw material level, there are no second sources and maintaining a safety stock somewhere in the supply chain is the only practical solution.

The same applies to bespoke components, such as springs and sheet metal parts that are not standard catalogue items. However, in some cases, even if it means lowering the purchased volume per vendor and thus buying with slightly less favourable terms, it might make sense to build up an alternative vendor for such components.

After a period of crises and unprecedented growth, supply chains have been challenged and it is unclear what the future holds, not least with tariffs and trade wars. Combination products are here to stay and will continue to require significant capacity increases to meet the demand fuelled by innovative new biopharmaceuticals, as well as by the next wave of biosimilars.

However, it is an open question as to how multi-dose and reusable devices will develop given the pressure to go carbon neutral. Are obesity treatments ever growing or subject to the well-known hype-cycle that will see a collapse of demand in the future before stabilising at a steady level? The answers to these questions may be largely unknown, but Ypsomed is confident that, with flexible self-injection platforms, adaptable, geographically distributed manufacturing setups, and equipment diversity and redundancy, the company is well prepared for a broad range of scenarios that may play out in the future.