To Issue 152

Citation: “Accelerating Access: The Future Of Injectables Is Prefilled And Plastic – an Interview with ApiJect’s Bo Kowalczyk and Jon Ellenthal”. ONdrugDelivery, Issue 152 (Oct 2023), pp 18–22.

“Absorbing a giant unexpected spike in demand created dangerous shortfalls in parts of the injectable medicines industry.”

Q What are the supply chain issues impacting glass based sterile fill-finish services during and after covid-19?

JE Supply chain constraints and failures were so widespread during the covid-19 pandemic that the Merriam-Webster dictionary added the term to its dictionary in 2022. And it’s no wonder. The pain was universal across industries, and sterile fill-finish processes for glass vials were severely impacted. We frequently hear stories of wait times of 12–18 months to get on filling lines.

The larger CDMOs have access to the necessary raw materials for sterile fill-finish, but increased demand has consumed their capacity for about the next 12 months. On the other hand, the smaller sterile fill-finish CDMOs have capacity, but are finding it challenging to procure the required raw materials in a timely manner. In either case, pharma and biotech companies that don’t already have contracts in place face long lead times, impacting product launch, limiting response to increased patient demand, or creating delays in clinical trials.

The problem is made worse by the limited surge capacity in the system for manufacturing and fill-finish of glass vials. There simply isn’t enough unused capacity at any moment to respond to completely unexpected spikes in demand, such as happened during the pandemic. The reality is that building new capacity is both costly and time-intensive, and few companies are prepared to expand capacity until there is proven, tangible long-term demand.

However, limited surge capacity is only part of the dynamic that limits resilience in sterile fill-finish services. The current process for making and filling glass vials is a complex, multi-dozen step process, using up to seven locations and depending on more than a dozen raw materials. Borosilicate glass, rubber stoppers, aluminium crimps, silicon and other materials need to be sourced from vendors across the globe with each component being critical to complete the process. And, as we saw during the pandemic, international agreements were sometimes overridden in the interests of vaccine nationalism.

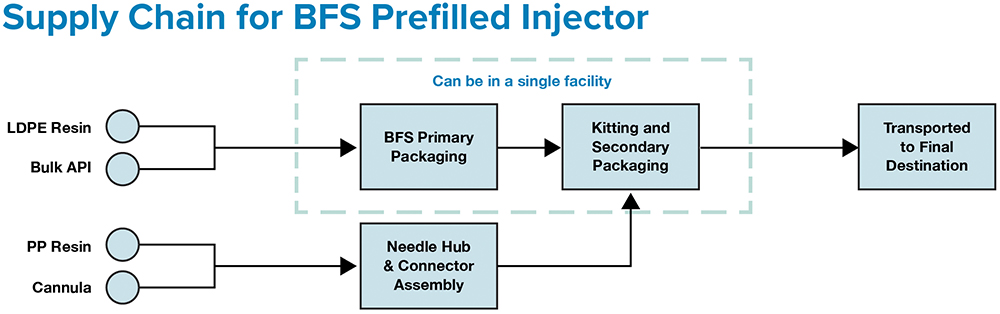

Figure 1: ApiJect’s supply chain can require as few as two facilities – one for BFS fill-finish and one for attachable component manufacturing.

Contrast this with ApiJect’s compact supply chain (Figure 1), which consists of the three raw materials, all locally sourced and stockpiled, used to make ApiJect’s device in a single facility using a highly automated, advanced aseptic Blow-Fill-Seal (BFS) manufacturing process. Glass vial and prefilled syringe sterile filling is a complex process with demanding logistics that are challenging under normal commercial conditions, let alone during global emergencies.

Figure 2: Rising demand for affordable drugs and prefilled syringes is driving fill-finish manufacturing growth.

Q What is the outlook for the injectable medicines and vaccines market until 2030, and to what extent has the covid-19 pandemic influenced this market?

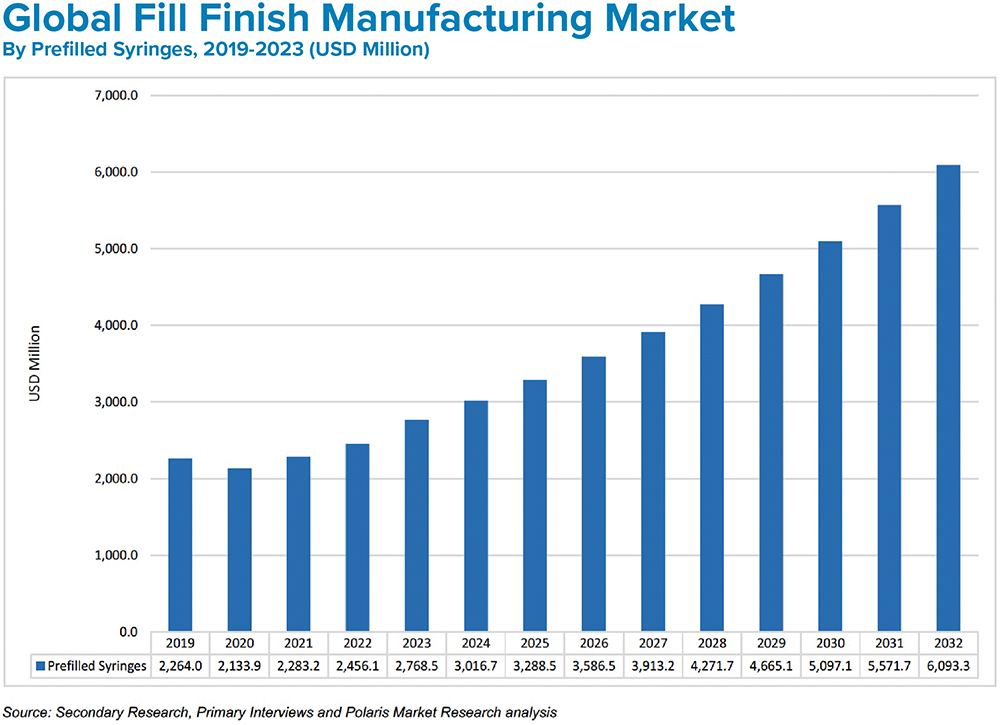

BK The market for medical injections continues to grow at a healthy pace. Experts estimate current global demand to be near 50 billion injections annually, which is expected to grow to 70 billion over the next five years. This translates to a global injectable drug delivery market size that was valued at US$434 billion (£351 billion) in 2022 and is expected to reach $1,040 billion (£841 billion) in 2032 at a CAGR of 10.2% during the forecast period (Figure 2).1 Prefilled formats are the fastest growing segment (Figure 3). The increasing use of biologics, which are primarily administered through injection; the rising incidence of chronic disease; an ageing population; and the rising urbanisation and medical infrastructure all indicate the market for injectable medicines will continue to expand.

Figure 3: Growth in fill-finish manufacturing is being driven by affordable drug demand and increasing adoption of prefilled syringes.

“No-one had ever figured out how to attach a needle to a BFS

container and turn it into a prefilled injection device.”

Keeping up with growth can be challenging under the best of conditions, but the covid-19 pandemic created an environment that is far from ideal. Absorbing a giant unexpected spike in demand created dangerous shortfalls in parts of the injectable medicines industry. That means the industry must prepare for organic growth and play catch-up at the same time. Clinical trial enrolment declined by up to 70% between 2020 and 2022 due to covid-19 quarantine protocols and diversion of resources to covid-19 related therapies and vaccines.2 Since the pandemic ended, clinical trial enrolment has reached pre-pandemic levels, further increasing the demand for sterile injectable fill-finish services.

Looking at the impact of covid-19 on childhood immunisation rates, capacity and materials that would have otherwise gone to childhood vaccination programmes were redirected to meet the demand for covid-19 vaccinations, mostly for adults.3 This has created a crisis in which an estimated 50 million “zero-dose” children have received no standard vaccinations whatsoever, while another 20 million have received some, but not all, of their needed vaccinations.

Q What are the market trends, both in terms of technology and patient needs?

BK Changes in technology and patient needs are creating exciting new opportunities for innovation in drug packaging and delivery. The industry is seeing new primary containment materials that reduce the industry’s reliance on complex and energy-intensive glass manufacturing; injection formats that lend themselves to easier self-administration for at-home use; and simplified manufacturing processes using compact supply chains that improve reliability and resilience.

The use of biologics continues to grow, most of which are administered by injection. In fact, 55% of all new drug candidates in the global R&D portfolio are injectables. There are more than 5,000 biopharmaceuticals in the development pipeline alone.4

Work is also being done in the area of emergency response to better prepare us for the risks of modern life. The pandemic exposed the need for rapid manufacturing scale-up for vaccine fill-finish. In a world where a pandemic is no longer an abstract idea and advances in synthetic biology increase the risk of a man-made pathogen being released, some in the industry are working on building much more robust emergency capabilities for the next time.

“The entire process is supported by a simple supply chain that relies on three readily available and widely used raw materials – LDPE plastic and polypropylene resin and cannula – all of which can be stockpiled.”

Q What is ApiJect, what was the impetus to start the company and what are the key problems and challenges you’re trying to solve?

JE ApiJect is a medical technology company with a mission of making injections safe and accessible for everyone worldwide. Our founder is Marc Koska, the inventor of the K1 auto-disable syringe (Star Syringe, London, UK), for which he was awarded an OBE. Approximately 20% of all syringes used during covid-19 were the K1. Originally, Mr Koska was focused on eradicating the scourge of unnecessary death from unsafe injections in medical settings in the developing world, largely from the reuse of syringes. Believe it or not, globally, more people die from syringe reuse and unsafe injection practices each year than from car accidents. That’s more than one million people every year.

Mr Koska realised that his auto-disable syringe helped, but he needed something more to eliminate the problem. His search for a single use, prefilled device at an affordable cost for low- and middle-income countries led him to the extraordinary scale and efficiency of BFS manufacturing. BFS uses medical-grade plastic resin instead of glass. Today, more than 50 billion sterile liquid doses every year are packaged in BFS containers. However, no-one had ever figured out how to attach a needle to a BFS container and turn it into a prefilled injection device.

That was the problem that Mr Koska aimed to solve, and his invention is the basis for an entire medical technology platform that can be used to create a range of BFS-based injection devices. Plastic is incredibly flexible, lightweight, durable and has a lower carbon footprint than glass. That is why, back in the early 1970s, glass bottles for intravenous infusion were replaced by plastic. And we have seen the same story across many industries.

While initially developed with global health markets in mind, the underlying technology has a broad range of applications across the industry. Today, ApiJect is focused on commercial pharma, global health and bio-emergency response. In 2019, when the US government signed an agreement with the company to begin development of emergency response capacity, it was before the emergence of covid-19. Months later, when covid-19 emerged, ApiJect intensified its focus with additional support from the US government on creating a device and sterile fill-finish process that could be manufactured at population scale.

Q What distinct advantages does the ApiJect platform offer compared with injectable platforms reliant on glass, and how will both sponsor and patients benefit?

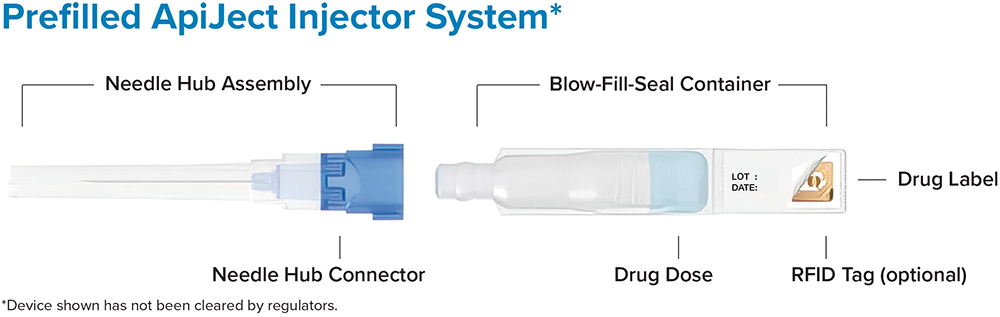

JE The ApiJect platform enables an entirely new category of prefilled injection devices (Figure 4) that can be produced at a cost that makes prefilled devices available to many more injection types and environments. It provides the safety, quality and convenience of a prefilled format at the same or comparable cost per dose to that of a multi-dose vial and disposable, manually-filled syringe – which was previously the market’s low-cost leader. The entire process is supported by a simple supply chain that relies on three readily available and widely used raw materials – LDPE plastic and polypropylene resin and cannula – all of which can be stockpiled.

Figure 4: The ApiJect single-dose prefilled injector.

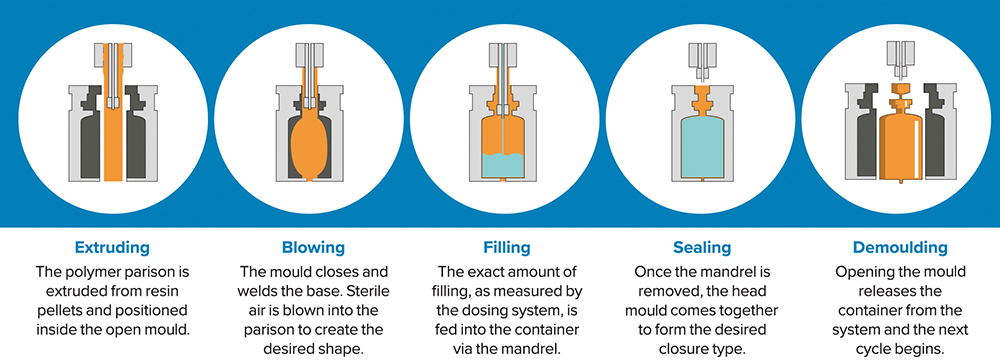

The BFS manufacturing process creates, fills and seals the drug container in one continuous aseptic process that takes seconds and can create as many as 25 containers at a time (Figure 5). A single BFS production line can manufacture up to 15 million prefilled units per month. ApiJect combines the finished container with a proprietary, insulin-style needle hub to create a high-quality, ready-to-use injection device.

The key advantages are a flexible, rapid device design process that can meet many pharmaceutical products’ needs; an affordable prefilled format; a simple supply chain; a giant production scale; short lead times; a simple, easy to use design that opens the door to self-administration or use by community health workers in low and middle-income countries; and a lower carbon footprint by avoiding glass and using less plastic than a traditional syringe.

Figure 5: BFS technology creates, fills, seals, inspects and labels a container in a single integrated process that takes 3–7 seconds.

Q What is ApiJect’s strategy to bring forth this new technology platform and what measures are in place to mitigate risk for sponsors in an industry filled with fast followers?

BK The company is close to filing for regulatory clearance for our first prefilled BFS injection device, which is suitable for sterile liquid doses of 1.0 mL or less and intramuscular administration. Additionally, we have a deep product development pipeline. We aren’t aware of another company making the type of investment we are in developing affordable, BFS-based injection devices.

ApiJect operates a concept design studio in London (UK) led by Mr Koska. The studio does a great job of showing the potential for all kinds of problem-solving devices. We also have a technology development centre in Orlando (FL, US) to accelerate R&D in both process and format. We employ a full in-house product development team that takes prototypes through all the design and development steps needed to manufacture at scale. Additionally, Tae-Chang Industrial (Gongju-si, South Korea) is our exclusive partner for needle hub development, and we greatly benefit from its engineering expertise.

Our job is to make to make injectable medicines and vaccines safe and accessible to everyone and, as long as we stay dedicated to this mission, we will deliver significant value to our sponsors for the long-term. We’re looking for sponsors to co-develop a combination product of their vaccine or therapeutic drug using the ApiJect device. There are well-established development and regulatory paths to reach regulatory authority submission within 18 months of starting a programme. We have a low-risk, low-cost plan to make it happen.

REFERENCES

- “Injectable Drug Delivery Market, By Product Type (Devices and Formulations), By Route of Administration (Intravenous, Intramuscular, and Subcutaneous), By Usage (Curative Care and Vaccines), By End-use (Hospitals, Clinics, and Home Care Settings), and By Region Forecast to 2032”. Research Report, Reports and Data, Apr 2023.

- McDonald K et al, “Quantifying the impact of the covid-19 pandemic on clinical trial screening rates over time in 37 countries”. Trials, 2023, Vol 24(1), p 254.

- “Covid-19 pandemic fuels largest continued backslide in vaccinations in three decades”. Press Release, WHO, Jul 15, 2022.

- “Fill Finish Manufacturing Market Share, Size, Trends, Industry Analysis Report, By Product; By End-Use; By Region (North America, Europe, Asia Pacific, Latin America, Middle East &Africa); Segment Forecast, 2022 – 2030”. Research Report, Polaris Market Research, Nov 2022.