Citation: Monroe N, “Industrialisation of Drug Delivery Beyond Manufacturing”. ONdrugDelivery, Issue 123 (Aug 2021), pp 4–9.

Napoleon Monroe considers the impact of the changing technological landscape on how industrialisation in the healthcare industry is evolving, with reference to the idea of “patients as consumers” and how the relationship between consumers, information and industry has evolved in other sectors, such as tech and retail – and how big players in those sectors are looking to move into and disrupt healthcare.

While the US drug delivery industry is already highly industrialised, it is currently poised for radical change. The healthcare ecosystem includes multiple other industries which impact drug delivery, and the covid-19 pandemic has catalysed acceptance of change in healthcare. Technology can provide tools to improve access to care and health outcomes, as well as enabling the sharing of information between industrial silos and the patient population. Drug delivery companies employing smart, patient-friendly digital technology can disrupt, or even creatively destruct, existing industrial healthcare silo models.

FOUNDATIONAL ELEMENTS – INDUSTRIAL STRATEGY AND TACTICS

As noted, healthcare, including pharmaceuticals and drug delivery, is already industrialised. Articles in ONdrugDelivery’s “Industrialising Drug Delivery” issues tend to be on improved products and innovation in manufacturing processes, platforms and systems, all of which are important developments. However, here we’ll step outside the typical coverage to discuss the industrialisation of customer/patient centricity in drug delivery and elsewhere (Figure 1).

There has been a great deal of discussion recently about defining the foundational elements that determine the success of a society or national economy. It is also interesting to ask about the foundational elements of the industrialisation of a given industry. These two subjects share some common themes.

Industrialisation is clearly foundational for a successful world economy. Digitisation and related technological advances that support the acquisition and analysis of data are the technologies currently driving the industrialisation of drug delivery and healthcare. Some other foundational necessities for the industrialisation of drug delivery and healthcare are:

- A respect for scientific principles

- Concern for the general welfare of – and providing value to – the population (patient-centricity)

- Coherent messaging of basic objectives

- Reversal of unduly restrictive laws that disadvantage broad sectors of the general population; allowing women access to birth control is a drug delivery example; and the repeal of certain tariffs that have effects similar to the Corn Laws is a more general example

- An uncorrupted legal system that is fairly and uniformly enforced

- Access to capital

- Acceptance of positive changes.

Figure 1: … As the great detective might say.

With all of those in place, some of the other foundational elements for successful industrialisation of drug delivery are an understanding of:

- Internal objectives

- Internal funding

- Drugs and their target diseases

- Onboarding, training, continuing instruction and change management

- Scalability of proposed programmes

- Markets and competitors

- Potential partners and related contractual terms

- Patient demographics

- Laws and regulations

- Reimbursement possibilities

- Traditional and novel technologies

- Trends.

Finally, once those are pretty well understood, come the harder parts – understanding patients’ and other stakeholders’:

- Knowledge

- Limitations

- Human factors

- Desires

- Trust relationships

- Behaviours

- Expectations

- Biases

- Abilities

- Roles

- Relative importance

- Unknown unknowns.

For a list of some stakeholders, please see the list in our August 2018 ONdrugDelivery article.1

“By providing better patient information, a disruptor could help to ensure compliance and adherence, prevent the need for product returns, keep the supply chain secure and reduce the overall cost of healthcare.”

IDUSTRIALISATION IN NEW INDUSTRIES IS NOT NEW

Henry Ford made the automobile an affordable “necessity rather than a luxury”. He fought off an association that tried to bankrupt his fledgling company by speciously claiming that Ford infringed a patent controlled by the association. Ford himself patented some 150 inventions. While he was doggedly independent and held some highly controversial views, he industrialised automobile manufacturing with the scalable assembly line. The Ford Motor Company thrived while most of its 250 competitors in the 20th century disappeared. Alongside General Motors and Chrysler, Ford dominated the US automobile market until international manufacturers, such as Toyota and Volkswagen, disrupted the growth of the “Big Three” in the 1960s and 1970s.

In an obvious strategic move, Ford secured more than 2,000 patents by 2020, and has filed more autonomous vehicle patents than any other automaker. As of 2019, Ford led Google and Amazon in the number of patents held.

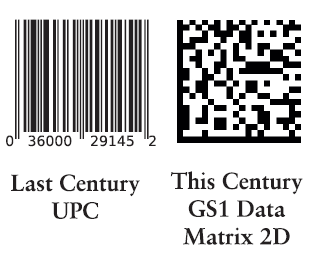

Figure 2: While it’s almost unthinkable for a consumer product today to not bear a barcode, in the 1980s they were a revolutionary idea in the retail industry.

INNOVATION IN EXISTING INDUSTRIES IS NOT NEW

An example of a major innovation that we now see as a universal and foundational part of an industry is the use of automated product identity and data capture (AIDC), most commonly embodied as barcodes (Figure 2). Last century, in the 1980s to be precise, Walmart demanded that its vendors apply a universal product code (UPC) to the products they bought for sale. In 1983, Walmart began using UPCs as part of the checkout process and extended their use deep into its supply chain management. There was and is still no regulatory requirement for a barcode.

The entire retail industry followed. This led to tremendous changes in the availability of sales and supply chain information and massive savings. Laws and rulemaking requiring AIDC on prescription drugs and many medical devices were introduced in the US in 2013. Manufacturers and distributors have largely implemented AIDC marking on schedules that have been pushed back several times – provider implementation still generally lags very behind. For example, the use of AIDC on some covid-19 related products was delayed to allow faster fielding.

More on Walmart as a Potential Disruptor

Today, Walmart remains the largest retailer by sales volume in the US (there will be more on the second largest US retailer later in this article). From this position, Walmart is looking to break into the healthcare industry.

In late June 2020 Walmart announced the introduction of a generic private brand insulin made by Novo Nordisk. Furthermore, since opening its first clinic about a year ago, Walmart has announced plans for at least 20 more. Walmart has formed relationships with Clover Health and Humana. Then, in June 2021, Walmart Health was announced as the company’s healthcare division, thanks to the acquisition of telehealth provider MeMD.

AIDC can be a tool for Walmart or other disruptors. By providing better patient information, a disruptor could help to ensure compliance and adherence, prevent the need for product returns, keep the supply chain secure and reduce the overall cost of healthcare.

“Pharma firms are fastidious in filing patents on their compounds. However, in some companies, recognition of the importance of patents related to drug delivery devices sometimes seems to be seen as lower priority than it ought to be.”

PHARMA IS A WELL-ESTABLISHED INDUSTRY WITH A HISTORIC FOCUS ON INTELLECTUAL PROPERTY

Patents are clearly an essential strategic element in the pharmaceutical industry’s historic successes. Pharma companies often file patent after patent to extend their period of exclusivity. Manufacturing, marketing, sales and other functions execute on key innovations, but it is IP, not manufacturing expertise or marketing muscle, that enables the industry’s hefty gross profit levels. Accordingly, pharma firms are fastidious in filing patents on their compounds. However, in some companies, recognition of the importance of patents related to drug delivery devices sometimes seems to be seen as lower priority than it ought to be.

Patient drug delivery management will provide information on efficacy and safety. Data about medications in patients’ hands has moved beyond “nice to have but too complicated and expensive to bother with except in clinical trials.” Drug delivery management and the data derived from it are now drivers of value.

Amazingly, the zest to build patent walls on drug delivery data has somehow been seemingly overlooked by much of pharma. Research on forward citations for some drug delivery patents indicates that drug delivery management “sorta snuck up on many large pharma companies”. The march towards drug delivery management has been quickened to double time in the US by high pharma product costs, demands for real-world evidence of the value of improved outcomes, new regulatory requirements for lifecycle management and the recognition that data is essential to corporate performance. The technologies are in place for the disruption of the legacy healthcare pharma, provider, distributor and payer industries. Self-disruption is a possibility.

A new sub-industry of contract developer and manufacturing organisations (CDMOs) has been built around pharma’s need for outside expertise in electromechanical medical devices capable of data capture. Over some years, CDMOs have been vertically integrating to fulfil pharma’s needs. In some cases, CDMOs have filed patents on devices and systems to then licence their IP to pharma customers.

Fundamental changes to drug delivery management data will likely disrupt legacy systems by offering patients and society better pharma outcomes. The resultant changes may offer healthcare practitioners freedom from some of the bureaucratic legacy practices – we can hope. Delivery device and data technology IP can serve to build new or augment existing proprietary pharma positions.

A venture capitalist friend said “IP is rarely a wall, but a creative assembly of bricks to maintain legitimate pharma monopolies devolving from high-risk, high-capital R&D.” Patents covering data retrieval from smart connected combination products is a valuable brick in this wall – and a brick through the window of legacy thought. Automated identity enables:

- Product control

- Dissemination of drug and device product information

- Digitisation to generate real-world data for analysis and conversion into real-world evidence

- Understanding the effect of human variables following the stability, exposure and sensitivity of biologic products

- Tracking versions of software in or associated with drug delivery systems and medical devices.

These and other requirements argue strongly that healthcare should make AIDC part of its industrialisation efforts.

“GHX and many other companies have filed multiple patents related to connected drug delivery to support the shift towards favouring at-home self-administration by patients over the traditional healthcare practitioner-based in-clinic model.”

ONE OF THE MANY OTHER POTENTIAL DISRUPTORS EMPLOYING DRUG DELIVERY DATA

Global Healthcare Exchange (Louisville, CO, US), or “GHX”, states that its services have enabled better patient care and billions of dollars in business processes savings for the healthcare community. GHX claims to be the world’s largest digital trading network for healthcare data, bringing in US$1 billion (£730 million) per year for the 4,100 US providers and 600 suppliers that contract for its service. In a blog post,2 GHX announced its plans to support moving patient care outside of traditional care sites even to patient homes.

In an article for Health Data Management, Chris Luoma of GHX explored how the supply chain can support this change.3 Contracting and procurement have seen progress with standardisation and technology systems that generate data to support strategic sourcing.

GHX may also look to comparing outpatient versus in-home administration of medications. GHX and many other companies have filed multiple patents related to connected drug delivery to support the shift towards favouring at-home self-administration by patients over the traditional healthcare practitioner-based in-clinic model.

Pharma drug delivery management technologies can save lives and enhance patient quality of life. Value for pharma products can be enhanced and demonstrated by connectivity technologies and IPs that help to ensure improved outcomes. The question is: Who will be the first to really break through and make use of connectivity to gain real-time information and disrupt the current drug delivery industrial norms?

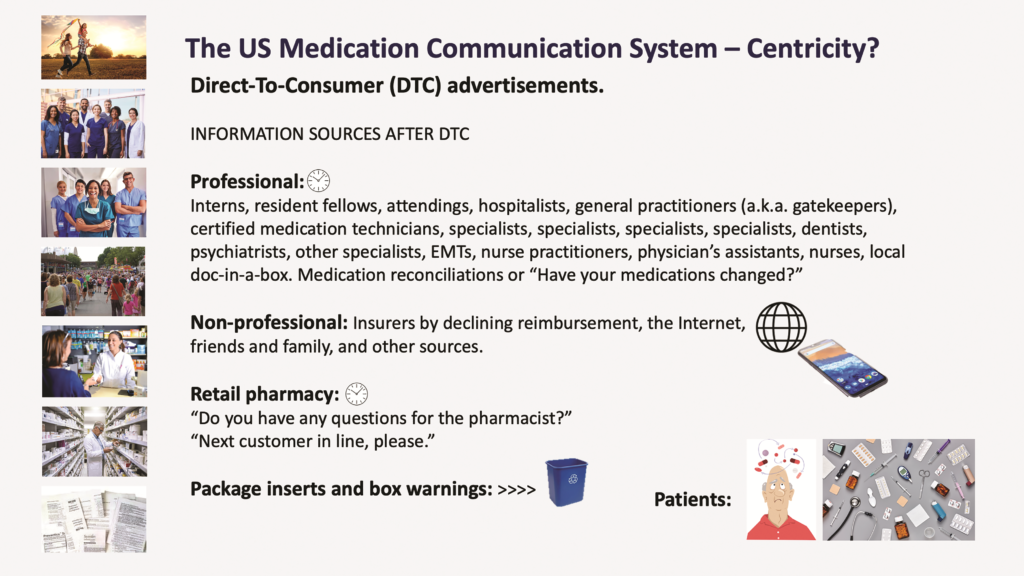

DATA IS NOT PATIENT SUPPORT, TRAINING OR EDUCATION

Drug delivery includes, or should include, patient and caregiver support, training and education. The gaps in the current information supply norms shown in Figure 3 are obvious to patients and, until somewhat recently, that was all that was offered. Patients were not usually well informed about the drugs that they were prescribed.

Figure 3: Information sources for patients in the current US healthcare industry.

“2020 was a banner year for pharma and other healthcare, hospital and insurance industries in total expenditures on advertising and lobbying. Patient and consumer groups remained far behind in funding their efforts.”

For many insured patients, drug costs have not been a significant factor in their relationship with their medication regimes. However, newer drugs are often more expensive, the media and legislators have emphasised drug costs, fewer patients have employer-provided insurance coverage and insured patients are now often required to pay a greater share of their pharma expense than in years past. New drugs have been approved for previously unidentified diseases that affect smaller populations or for conditions that have thus far been treated by less-effective drugs or left untreated altogether. These facts have driven a greater desire in the patient population for pharma information, which, coupled with the ready access to consumer information in other sectors, has led to the situation now where pharma must increasingly deal with patients/payers who have come to expect instant gratification of their desire for product information.

Some not-for-profit consortia, such as GTMRx (Tysons Corner, VA, US), are proposing better systems. Others are lobbying for legislation to empower patients. Also, many drug price comparison companies have now entered the US market, with GoodRx (Santa Monica, CA, US) being a leading example. Further industrialisation in pricing data supply is coming and disruption from various commercial entities, including diagnostics providers, is underway. One way to offer greater patient value for a treatment is for it to include more features for the patient.

Even though pharma has invested in patient support programmes, including payment assistance programmes, patients’ use of them is very limited. Patient payment assistance is usually advertised as: “If you cannot afford your medication, pharma company X may be able to help.” However, 2020 was a banner year for pharma and other healthcare, hospital and insurance industries in total expenditures on advertising and lobbying. Patient and consumer groups remained far behind in funding their efforts.

Investing in digital and personalised consumer (patient) communications and consumer satisfaction (including patient outcomes and loyalty on the part of patients and other stakeholders) is a medium- and long-term strategy that can maximise both corporate value and patient outcomes. Such investments are different from environmental, social and governance (ESG) investing, which is criticised in the US as being ineffective, misplaced, elitist and “woke”.

Pharma has done a remarkable job of identifying, scaling up and distributing covid-19 vaccines in response to the current global pandemic. However, failure to provide effective patient support, training and education on drug delivery can lead to:

- Unfilled prescriptions

- Failure to follow protocols

- Reduced efficacy

- Poor patient outcomes

- Emergency service overuse

- Unnecessary hospitalisations and deaths

- Wasted expenditures. Effective patient support, training and education for the covid-19 drug delivery effort was missing to date in many countries. Now is the time to prepare to help patients end the current pandemic and respond to the next pandemic event.

“Legacy companies may struggle to prevent Amazon and others from making their presence known as the disruptors move into the sector.”

INDUSTRIAL HUBRIS CAN BE DISASTROUS AND COSTLY

Volkswagen of America introduced the luxury Audi 5000 in 1978. The marketing slogan “Audi – The Art of Engineering” was used to differentiate the brand and Audi 5000 sales rose significantly over the years. With increasing sales came increased consumer complaints of unexpected sudden acceleration when shifting from “park” to “drive” or “reverse”. Complaints included some accidents and fatalities.

For years, Volkswagen of America denied that the car was defective and blamed inexperienced, or even “short”, drivers for the accidents. In 1987, after five recalls, a number of design changes and a public relations blame storm, Audi 5000 sales and Audi sales overall had declined by more than 50%. The Audi 5000 name was dropped in 1988.

The Boeing 737 and its variants was the bestselling line of commercial passenger planes until 2019. The 737 MAX was rushed into service in May 2017. The MAX suffered recurring failures of its automated flight control systems, which were eventually found to have contributed to causing two fatal accidents. A lack of costly pilot training probably contributed to the accidents.

The MAX was subsequently grounded worldwide from March 2019 to November 2020. Investigations indicated a cover-up of known defects by Boeing and lapses in the certification process by the US Federal Aviation Administration (FAA). After being charged with fraud, Boeing paid settlements amounting to more than $2.5 billion. In late 2000, the FAA cleared the MAX to resume service, subject to mandated design and training changes.

However, about six months after the MAX was cleared to fly again in the US, a potential electrical problem caused renewed grounding of more than 100 737 MAX planes and a suspension of MAX deliveries. Boeing’s 777X and 787 Dreamliner, originally scheduled for 2019–2021 deliveries, and the new Air Force One, are far behind schedule. Airbus has since taken the lead in passenger plane sales.

The reported financial costs of these types of hubris are high. Non-financial costs are difficult to calculate and are probably even higher. Listening to and adopting different approaches to customer, driver, pilot and engineering support education and training might have mitigated damages.

“As with other social media, these voices are changing the amount and content of drug delivery information and influencing a change in drug delivery models. Pharma, payers, practitioners, regulators and others are coming to rely more on patient input well beyond the clinical trial.”

PATIENTS AS CONSUMERS – AND THOSE WHO SERVE THEM

The big tech companies, such as Amazon, Apple and Google (Alphabet), “get” the consumer desire for information. These and other companies have built their success off consumer desire for convenience, online access, competitive pricing, information, support, education and training. Amazon’s subscription model, one-click shopping, preferred product selections, verified purchase reviews, personal order history and “customers also bought” features all readily provide information to consumers. Apple’s “Genius Bar” and Google’s assisted intelligence have changed the retail, publishing and online search industries. These companies and others provide tools, assist their customers and use their informatic tools to extend the functionalities of their supply chains to end users, vendors and other stakeholders.

Patient and caregiver reliance on internet-based information for most products is not as restricted as it is for pharmaceuticals. While the US allows direct-to-consumer advertising, there are still restrictions on what can be said in internet-based information. Patients, however, can say what they want, leading to the idea of “ask your doctor”. Ask your doctor is being supplemented by corporate offerings of information and “voices of patients” online. As with other social media, these voices are changing the amount and content of drug delivery information and influencing a change in drug delivery models. Pharma, payers, practitioners, regulators and others are coming to rely more on patient input well beyond the clinical trial.

AMAZON AS A POTENTIAL DISRUPTOR

“Brick and mortar” retail booksellers were quite complacent when Amazon first began selling books in 1995. Amazon disrupted publishing and then much of retail distribution by providing customer choice, guaranteed satisfaction, service and information. In short – competition, which it provided on a massive scale. Amazon is now the second largest US retailer by sales volume (Walmart still holds the top spot). However, the changes introduced to the industry by Amazon were not without a darker side for some competitors and present a potential broader risk if abused.

Legacy companies engaged in drug delivery may now be trying to avoid similar disruption. New entrants and new combinations in drug delivery are worrying legacy stakeholders. Legacy companies may struggle to prevent Amazon and others from making their presence known as the disruptors move into the sector. Amazon, for example, has:

- A greater capacity for collecting and analysing data than many existing healthcare stakeholders combined

- Massive capital reserves

- A deep and through understanding of the US consumer market

- Know-how on gaining value through customer centricity

- The ability to synthesise a range of information to serve its customers both profitably and conveniently

- An extensive knowledge of US law

- Experience with a wide variety of vendor relationships

- An appetite for growth in the healthcare industry

- Independence.

A few of Amazon’s potentially disruptive entries into “healthcare without walls”, including telemedicine, are:

- In 2018 Amazon bought PillPack (Manchester, NH, US), which already held licences to distribute pharmaceuticals in 49 states. Publicly listed pharmacy companies took a hit to their stocks on the day Amazon announced the PillPack purchase.

- In November 2020 Amazon announced Amazon Pharmacy, which offered discounts of up to 80% on generic and brand-name prescription drugs to patients if they forgo using insurance. This being on top of its already substantial over-the counter pharma offering.

- In 2020 Amazon began building covid- 19 testing capacity for its employees. The test has been cleared by the US FDA. Diagnostics are essential to home health.

- In August 2020 Amazon introduced the Halo fitness tracker. Like Amazon Prime, Halo has a recurring fee. Halo has some features not available on the Apple Watch.

- In February 2021 Haven, the joint healthcare venture among Amazon, Berkshire Hathaway and JP Morgan Chase, was ended. Amazon learned from the experience.

- Amazon Web Services (AWS) promotes partner organisations, such as Murj (Santa Cruz, CA, US, which offers cardiac device care; Redox (Madison, WI, US), a digital health platform company; and others.

- In early 2021 AWS announced a four week accelerator programme open to digital health start-ups, assisting them by enabling collaboration with Amazon experts and their healthcare customers and partners. The programme is targeting paediatric and adult patients.

- Amazon has now signed up multiple employers to its in-house healthcare service, Amazon Care, a virtual health service benefit as part of the national expansion of its employee health service.

The readers of ONdrugDelivery will be key in deciding who will innovate, who will lead, who will disrupt and how further industrialisation of drug delivery will evolve.

REFERENCES

- Monroe N, “Beyond Manufacturing: Industrialisation of Drug Delivery in the Real World”. ONdrugDelivery, Issue 89 (Aug 2018), pp 20–23.

- “Healthcare Supply Chain Poised for Success Beyond Hospital Walls”. GHX Healthcare Hub, July 2019.

- Luoma C, “How the supply chain can support shifts in care sites”. Health Data Management, June 2019.

Previous article

UPDATE ON OXYCAPT™ MULTILAYER PLASTIC VIAL AND SYRINGENext article

PUTTING POST-PANDEMIC SUPPLY CHAINS TO THE TEST