To Issue 142

Citation: Simpson I, Spooner G, “Opportunities for Innovation with Biosimilars”. ONdrugDelivery, Issue 142 (Feb 2023), pp 8–14.

Iain Simpson and George Spooner investigate the use of drug delivery systems that support self-administration of biologics, and specifically biosimilars, for the treatment of chronic diseases. This article is based on research conducted by both authors as part of the MPhil in Therapeutic Sciences at the University of Cambridge (UK) and supported by Phillips-Medisize.

“Autoinjectors have now become a market expectation in many disease areas.”

Biosimilars are biological medicines that closely resemble an already-approved biologic, referred to as the reference product. Their principal advantage is that they are usually priced much lower than the originator medicine, in some cases by more than 50%,1 yet provide the same clinical benefits and safety. Europe has led the way with biosimilars of more than 16 different reference drugs available as of 2020. The US has lagged behind Europe with biosimilars approved for nine reference drugs but only six actually available in the market due to patent litigation and also the 12-year exclusivity period that the US allows for biologic drugs – longer than that for many other regions.

With more than 30 biologics losing exclusivity in the US between 2023 and 2028, and efforts being made in the US to address their historic slow uptake, we may see an acceleration in the approval of biosimilars. It has been estimated that the US biosimilars market will grow from US$9.48 billion (£7.76 billion) in 2022 to $100.75 billion by 2029 – an annual growth rate of 40.2%.2

The rise of the biologic drug has driven increased use of drug delivery devices that can better support subcutaneous self-administration of these drugs for chronic diseases. Although originally a source of differentiation, autoinjectors have now become a market expectation in many disease areas, so it is not surprising that biosimilar companies have frequently chosen to follow suit when entering the market. Even with a significant price advantage, only offering a biosimilar in a vial or prefilled syringe (PFS) would likely limit market uptake.

Innovation through drug delivery technology has been a common defence mechanism for the originator biopharma companies against biosimilars. A good example of this is the Onpro® wearable pump for Neulasta® (pegfilgrastim) developed by Amgen, administered 24 hours or longer after chemotherapy to reduce the chance of infection due to a low white blood cell count. Normally this requires an additional visit to a clinician, but Onpro allows the device to be applied at the end of the last chemotherapy session and then the drug to be automatically delivered 27 hours later. In the US, this allows the prescribing clinician to claim a fee for administering the dose and the patient benefits from avoiding a further visit.

Onpro was approved and launched in 2014 in the US and its share of the Neulasta market rapidly grew to 62% of the market by 2018, when the first biosimilar version of Neulasta was approved by the US FDA. Since then, five further biosimilars have been approved but none with a wearable pump to support delayed delivery. By 2021, data from Amgen3 suggest these have gained around 37% of the Neulasta market but Onpro still commands 51% of the market and the originator Neulasta PFS a mere 12%. This suggests that the Onpro device has successfully protected 50% of a $3 billion US market. In Europe, the uptake of biosimilars that reference Neulasta has been much quicker – reaching 42% of the market in 2020, compared with only 29% in the US. Although Onpro is also approved in Europe, it appears to afford less of a commercial advantage, potentially due to different reimbursement processes.

Electronic autoinjectors have also entered the market for some of the lead drugs – AutoTouch® for Enbrel (etanercept, Amgen), ava® for Cimzia® (certolizumab pegol, UCB), BETACONNECT™ for Betaseron® (interferon beta-1b, Bayer), Rebismart® for Rebif® (interferon beta-1a, EMD Serono/Merck KGaA) and easypod® for Saizen® (somatropin, Merck KGaA) being the most notable examples. Published data show that these devices have been well received by patients and clinicians4,5 and show some positive outcomes around adherence and efficacy outcomes,6 although uptake has been limited. The reasons for their limited uptake are not fully clear in the published literature, but higher cost and trade-offs between the benefits and disadvantages that they offer users are likely confounding factors.

With a strong focus on price reduction and increasing competition amongst biosimilars for the same reference drug, biosimilar manufacturers have tended to focus on cost reduction through manufacturing efficiency rather than innovation around the drug and any associated delivery system. But there is some evidence their approach may change, in part to play the originators at their own game but also to seek differentiation from other biosimilars referencing the same biologic predicate.

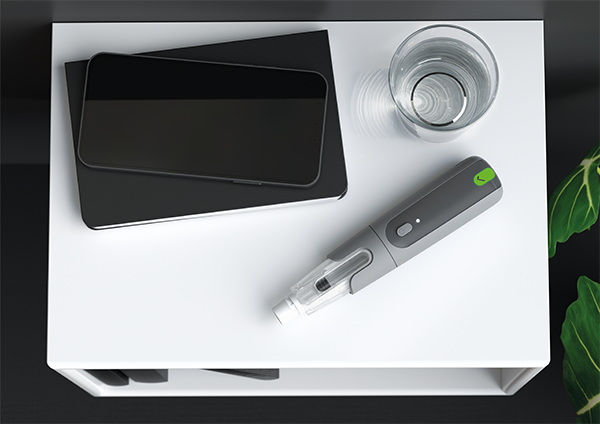

Figure 1: The Aria device.

In this article, we will look at two examples of where innovation with biosimilars has given some market advantage. We will then present the results of a research project conducted by George Spooner as part of a MPhil in Therapeutic Sciences at the University of Cambridge (UK) and supported by Phillips-Medisize. The aim of this work was firstly to understand the market dynamics for biosimilars in Europe and the US, and then to consider the opportunity biosimilars represent, for innovative drug delivery devices in general and, in particular, for the use of smart electronic autoinjectors. As described in previous work,7 smart autoinjectors, such as the Aria device (Figure 1) being developed by Phillips Medisize, offer distinct advantages around:

Environmental sustainability.

- Connectivity – particularly around the ability to capture, reliably and in real time, medication-use data that can be used to provide better patient support directly through a companion app or through more targeted support by healthcare professionals or lay caregivers.

- Improved ease of use, and patient feedback that can reduce use errors and potentially improve adherence.

- Flexibility and performance to enable the device platform to be more easily adapted to a wide portfolio of drugs. (Although this is mainly a benefit for pharmaceutical companies, it can enable patient benefits around variable dosing and the administration of combination therapies.)

The scope of the interview-based research was therefore structured to gain insight around these topics.

EXAMPLES OF INNOVATION WITH BIOSIMILARS

Intravenous to Subcutaneous Switching of Infliximab

Remicade (infliximab) was the first TNFα inhibitor approved in the US for the treatment of Crohn’s disease and subsequently for several other autoimmune disorders. It is delivered as an intravenous (IV) infusion in a clinic, which might be seen as a disadvantage compared with similar drugs such as Humira® (adalimumab, AbbVie) and Enbrel that can be self-administered. However, factors such as less-frequent administration and concerns around self administration for some patients meant it was well used, achieving sales in Europe in 2014 of around $2.3 billion.

In 2015, the first biosimilar versions of infliximab entered the market and, in 2020, Celltrion Healthcare gained approval for Remsima SC, a subcutaneous (SC) version of its infliximab biosimilar. Research in the UK suggests a saving for the UK NHS of around £40 million per annum in reduced administration costs for Remsima compared with an infliximab IV infusion.8 Remsima now has over 50% of the EU market and it appears the SC version is set to grow its share of the market.

Autoinjector Innovation in the Delivery of Etanercept

Etanercept is used to treat several autoimmune diseases. The innovator version, Enbrel, is provided in the SureClick® autoinjector, or MyClic® pen, that require the user to press the device against the skin and then press a button to initiate the injection. Benepali™ was subsequently approved in 2016 as the first etanercept biosimilar and is also offered in an autoinjector. However, this device is a two-step device that eliminates the button and requires the user only to push the device against the skin to initiate injection.

In a preference study involving 149 nurses from Germany, France, Italy, Spain and the UK, 86% reported that their patients would prefer the Benepali autoinjector over the Enbrel SureClick®/ MYCLICK® device on the basis of it being easier to use and being “button free”. This is aligned with other user studies that suggest patients prefer two-step devices over button-actuated devices.9 It is not clear from published data that the better-perceived device has had an impact in the growth of market share, but Benepali is the leading version of etanercept in the five leading European markets.

RESEARCH METHODOLOGY

Secondary research was conducted to understand potential drug candidates for delivery by autoinjector and market dynamics for biosimilars, including reimbursement, with a focus on the UK and US. Interviews were then conducted with three main healthcare stakeholders – healthcare professionals (HCPs), healthcare payers and pharmaceutical companies – to explore the opportunity for novel drug delivery technologies in the biosimilars sector, as summarised in Table 1.

| Code | Sex | Country | Stakeholders | Role | Compensated? |

| GBP1 | M | UK | Payer | NICE TAC member | N |

| GBP2 | M | UK | Payer | NICE TAC member | N |

| GBP3 | M | UK | Payer | Health Economist and NICE advisor | N |

| GBP4 | M | UK | Payer | NICE TAC member | N |

| GBHCP1 | F | UK | HCP | NHS Rheumatologist | N |

| GBHCP2 | M | UK | HCP | NHS Consultant | N |

| USP1 | M | US | Payer | Pharmacy Director | Y |

| USP2 | F | US | Payer | Pharmacy Director | Y |

| USP3 | M | US | Payer | CMO at Commercial insurer | N |

| USP4 | M | US | Payer | PBM Commercial Strategy Director | Y |

| USP5 | M | US | Payer | Medicaid Drug Formulary Principal | Y |

| USHCP1 | M | US | HCP | Rheumatologist | N |

| USHCP2 | F | US | HCP | Medicaid Drug Formulary Principal | N |

| USHCP3 | M | US | HCP | Rheumatologist | Y |

| USHCP4 | M | US | HCP | Rheumatologist | Y |

| USHCP5 | M | US | HCP | Gastroenterologist | Y |

| USHCP6 | F | US | HCP | Rheumatology nurse practitioner | N |

| PC1 | M | UK | Pharma company | Medical Director | N |

| PC2 | M | Netherlands | Pharma company | Clinical Science Associate Director | N |

| REG | M | US | Regulator | Assistant Director FDA | N |

Table 1: List of participants interviewed. TAC = technology appraisal committee, CMO = chief medical officer.

Given the use of self-administered biologics in rheumatology, gastroenterology and dermatology, HCPs working in these areas were contacted and invited to take part in interviews. Healthcare payers are individuals who control market access of therapeutics: these include, in the UK, individuals on National Institute for Health and Care Excellence (NICE) technology appraisal committees; and, in the US, insurers and pharmacy benefit managers (PBMs). For the pharma companies stakeholder group, individuals involved in marketing, market access or drug delivery devices for companies engaged in the UK and/or US biosimilar markets were contacted. Suitable interviewees were identified through LinkedIn and academic directories, with “snowballing” used to ask interviewees for further individuals suitable for the study. Given the low recruitment of US stakeholders, recruiting agencies were used to identify and recruit additional payers and HCPs respectively. The individuals who received compensation or a financial incentive for their participation in the study are indicated in the right-hand column of Table 1.

“User studies suggest patients prefer two-step devices over button-actuated devices.”

The semi-structured interview guides were stakeholder specific and developed based on the preceding secondary research. Questions were open ended, non-leading and agnostic, inviting discussion surrounding biosimilar and drug delivery device (DDD) innovation, differences between bio-originators and biosimilars, and emerging DDD characteristics. Before each interview, interviewees received a participant information form outlining the purpose of the study, and data confidentiality and anonymity assurances. Interviewees could withdraw from the study at any point.

The interviews – mean length 49 mins – were all conducted by George Spooner, except for those with UK HCPs which were conducted by Phillips-Medisize due to university ethics guidelines. Interviews were conducted on Microsoft Teams or via a telephone call and digitally recorded.

Anonymised video/audio records were automatically transcribed by Rev.com, and the resultant transcripts checked for accuracy. The interviews were transcribed solely to ensure interview accuracy, with the data kept confidential. The data was analysed through thematic content analysis, with NVivo 12 used to facilitate the coding process. Analysis consisted of data familiarisation, open coding, theme searching, theme reviewing, theme defining and report production.10

Although meaningful results were achieved, several methodological limitations should be highlighted:

- The recruitment process may have introduced bias into the results.

- The sample size for the interviews was limited by the duration of the research project. Saturation was achieved in the UK payer and US HCP datasets, but not with the other stakeholder groups. Further work should seek to interview more individuals from these groups.

- Data only analysed by one individual with limited experience in qualitative analysis.

RESULTS

From the desk-based research, 16 suitable biosimilar targets for autoinjector delivery were identified, with the majority used in rheumatology and gastroenterology, as summarised in Table 2. The primary, interview-based research then identified cost savings as the principal uptake driver for biosimilars, but drivers for innovation, as well as some potential barriers for acceptance of biosimilars, were also identified.

Drug delivery technology was seen as important by HCPs, particularly in rheumatology where patients can have dexterity issues that affect their ability to manipulate a syringe.

| Brand | INN | Area(s) of Medicine | Device Presentations | Key Patent Expiry | |

| UK | US | ||||

| Actemra | tocilizumab | Rheumatology | PFS; PFP | 2017 | 2015 |

| Benlysta | belimumab | Rheumatology | PFS; PFP | 2026 | 2025 |

| Cimzia | certolizumab pegol | Rheumatology; Gastroenterology | PFS; PFP; e-Device | 2024 | 2024 |

| Cosentyx | secukinumab | Rheumatology | PFS | 2030 | 2029 |

| Emgality | galcanezumab | Neurology | PFS; PFP | 2031 | 2033 |

| Enbrel | etanercept | Rheumatology | Vial; PFS; PFP; e-Device | 2015* | 2028** |

| Hemlibra | emicizumab | Haematology | Vial | 2031 | 2027 |

| Humira | adalimumab | Rheumatology; Gastroenterology | PFS; PFP | 2018* | 2016** |

| Orencia | abatacept | Rheumatology | PFS; PFP | 2017 | 2019 |

| Remicadeϒ | infliximab | Rheumatology; Gastroenterology | PFS; PFP (Remsima biosimilar) | 2015* | 2018* |

| Repatha | evolocumab | Endocrinology | PFS; PFP; wearable | 2028 | 2029 |

| Simponi | golimumab | Rheumatology; Gastroenterology | PFS, PFP | 2025 | 2024 |

| Takhzyro | lanadelumab | Immunology | Vial, PFS | 2031 | 2032 |

| Taltz | ixekizumab | Rheumatology | PFS; PFP | 2031 | 2030 |

| Trulicity | dulaglutide | Endocrinology | PFP | 2029 | 2027 |

| Xolair | omalizumab | Immunology | Vial; PFS | 2017 | 2018 |

Table 2: Biosimilars candidates that could benefit from novel autoinjector technology. INN = international non-proprietary name, PFP: prefilled pen, e-Device = electronic autoinjector. *Biosimilars approved and launched. **Biosimilars approved but not launched. ϒRemicade is administered IV.

“HCPs generally supported connected health, believing that knowledge of patient adherence trends could aid treatment decisions.”

Smart Autoinjectors

The introduction of an electronic autoinjector was not seen by payers as being particularly innovative in itself, but a reduction in dosing frequency or a change in administration route (e.g. from IV to SC) were seen as more significant. Payers wanted real-world evidence (RWE) of improved patient outcomes with the delivery device if they were to pay more for a biosimilar with the device. US payers generally viewed the release of the AutoTouch electronic autoinjector for Enbrel administration as a lifecycle management approach in the face of biosimilar, although some US HCPs strongly recommended the device because of the benefits they see it offers to patients.

Sustainability

Environmental sustainability was considered by all stakeholders to be an increasingly important issue but not one that yet has that much influence on decision making by payers and HCPs. Payers were generally unwilling to pay more for environmentally friendlier devices but believed using less material could lead to cost savings. HCPs did not discuss the environmental impact of treatments with their patients, although some believed this could change as younger patients are diagnosed.

Connected Health

Based on current experience, payers were uncertain of the value of connected health systems and indicated they would only pay more if there was RWE of improved outcomes. US payers stated a connected device could facilitate value-based insurance design, whereby a patient’s cost sharing is altered according to their adherence. HCPs generally supported connected health, believing that knowledge of patient adherence trends could aid treatment decisions. However, pharma companies recognised concerns with connected health systems around patient confidentiality and data security requirements, and generally deem these systems to be not critical in competing with bio-originators already offering these systems.

Adoption of Biosimilars

In both markets, payers control which drugs and delivery devices HCPs can prescribe and whether existing patients should be switched to a biosimilar. When deciding which biosimilars to pay for and prescribe, UK payers gave almost no consideration to factors not affecting cost effectiveness and UK HCPs had to prescribe the cheapest drug available. US payers considered a biosimilar’s net price first, followed by its interchangeability status; an environmentally friendlier device conferred a slight advantage, but not connected health unless RWE of improved outcomes was available. US HCP preferences had some effect on which device was prescribed but only behind access and drug efficacy; they considered a device’s usability and sustainability, and the availability of a connected health system, as advantages which would positively influence their device preferences. Whilst pharma companies saw drug delivery as a major source of differentiation in the biosimilars sector, a device which substantially raised the manufacturing cost would be problematic due to the inevitability of future price erosion.

Payers and HCPs did not expect patients to be switched between biosimilars for financial reasons regularly (i.e. annually), although most expected an initial switch from the branded drug to a biosimilar. Drug delivery devices were not perceived to impact these transitions since patients could be retrained on the new device. UK HCPs were confident about their ability to switch patients and supported pharmacy-level substitution of biosimilars. US HCPs were generally in favour of switching and substitution, provided there was supporting data.

Potential Barriers to Innovation

Barriers in both UK and US markets included HCP preference and experience, reluctance to switch, unknown biosimilar companies, and branded companies’ defensive strategies. Several US-specific barriers were also found, including:

- Rebate “walls” implemented by the reference drug supplier to protect its market position

- Cost savings not being shared with payers

- Lack of administrative incentive and interchangeability.

“The extent to which injectable biosimilar uptake is impeded in the US will be revealed in 2023 with the launch of multiple adalimumab biosimilars – their success will likely inform many companies’ strategies in the future.”

For the UK, a lack of NICE appraisal for biosimilars was considered an issue. NICE has stated that guidance published for an originator molecule will apply to a biosimilar at the time it becomes available to the NHS so it does not automatically conduct a new appraisal. In general, this is a reasonable position to take, given the equivalence of the drugs, but cost savings associated with biosimilar use have the potential to increase accessibility. This is recognised and the arrival of adalimumab and etanercept biosimilars led NICE to conduct a new technology appraisal which found cost effectiveness in treating patients with moderate rheumatoid arthritis using these biologics11 when previously only patients with severe disease have been eligible.12 The use of novel drug delivery technologies would only be considered if it was felt this might impact outcomes that will improve cost effectiveness. For Remsima, NICE recognised the patient benefits but did not make a recommendation that favours this medicine over other IV forms of infliximab.13

In the UK as in many other markets, it is not permissible to switch from an originator drug to a biosimilar drug at the pharmacy without the agreement of the prescribing clinician. But in the UK, NICE guidance, an assessment of cost effectiveness, as well as clinical data that support the interchangeability of biosimilar drugs with their reference products, has driven the transition to biosimilars. The situation in the US is more complex, which partly explains the slower uptake of biosimilars in this market. However, US legislation does allow biosimilars that have been designated by the FDA as interchangeable to be substituted without the intervention of the prescribing HCP. This is clearly a potential advantage for the biosimilar provider, yet also creates a complication in looking to change to a more innovative device, at least until the FDA provides better guidance around this point. Present guidance seems to be confusing as it is in part encouraging innovation but also being unclear around the actual requirements to demonstrate equivalence between devices.14 Unofficial feedback gained from the FDA suggests a change from a disposable to a smart reusable autoinjector would not necessarily rule out interchangeability. However, further consultation with the agency would be required to determine this.

“In the same way that drug delivery technology has enabled differentiation in the innovative biologics market, it is likely to have an increasing role to play with biosimilars.”

DISCUSSION

To be successful in the market, biosimilars need to be significantly cheaper than the branded drug and price competitive with other biosimilars. Whereas the former would seem an obvious requirement, in the US and some European markets the branded drug provider has used pricing and rebate strategies to make this more challenging.

Considering improved drug delivery devices for biosimilars, payers control the market in both the US and UK, and primarily see differentiation based on net price, and will only pay more for a biosimilar with improved drug delivery technology if it shows RWE for improved clinical outcomes. Although evidence is emerging that smart delivery devices, potentially combined with a companion digital service, can improve adherence in real-world settings,6 a pull through to better clinical outcomes is more difficult to demonstrate. At present, biosimilar companies are unlikely to consider it feasible or worthwhile to gather the evidence in a controlled study to try to make a claim for reimbursement. Provided it does not compromise price competitiveness, drug delivery technology and associated digital services can be a differentiator that can drive use of a particular biosimilar and these create a benefit for the pharma company.

Sustainability is likely to become an increasingly important differentiator and creates a significant opportunity for more environmentally friendly devices – a trend that generally favours reusable devices over conventional disposable devices.15 The environmental benefits from a reusable device such as Aria would likely be realised for chronic biosimilar therapies as patients are unlikely to be changed regularly between biosimilars for non-clinical reasons, so the device should be used for its intended design life.

The NHS has taken a strong position on sustainability, with the aim of being the world’s first net zero national health service by 2040. Other healthcare providers are also increasingly focused on this concern. A 2019 study estimated that 4.4% of the global carbon footprint is associated with healthcare.16 Most of the leading global pharmaceutical companies have also set ambitious sustainability targets that include working with suppliers, including device companies, to reduce greenhouse gas emissions.

Fewer barriers exist to biosimilar uptake in the UK than the US, but benefits for advanced delivery devices are probably more likely to be recognised and valued in the US market, as has been seen for the Onpro device. Thus, whilst there may be more opportunity for biosimilars in the UK, there may be more opportunity for novel drug delivery technologies in the US. The extent to which injectable biosimilar uptake is impeded in the US will be revealed in 2023 with the launch of multiple adalimumab biosimilars – their success will likely inform many companies’ strategies in the future.

CONCLUSIONS

Europe (including the UK) has already seen a rapid uptake in the use of biosimilars over the past 10 years and this trend is expected to continue, with price remaining the dominant driver. This will improve market access and likely accelerate the number of patients who will receive treatment with biologics.

In the US, with more than 30 biologics losing exclusivity during the rest of the 2020s, the opportunities for biosimilars are also set to increase dramatically. Although barriers to entry will continue to exist, increased efforts to address the disparity in drug pricing between the US and other markets are likely to support this trend.

In both markets, there is likely to be increasing competition between biosimilar companies to capture market share. Assuming equivalent pricing, the ability to differentiate must be driven by the commercial activities that support the introduction and use of specific biosimilars compared with competing drugs. In the same way that drug delivery technology has enabled differentiation in the innovative biologics market, it is likely to have an increasing role to play with biosimilars. A drive to more self-administration of medication potentially benefits patients and payers and can be facilitated by better drug delivery technology.

Sustainability will become an increasingly important consideration. Biosimilar pharma companies may conclude that their own approach to corporate social responsibility requires use of more sustainable devices, which in term may increase a trend towards reusable devices. Healthcare providers and payers are already demonstrating an ambition to reduce their own carbon footprint and may well start to apply pressure to their suppliers, including the pharma and devices industries, to support this. Our research has shown a strong interest from patients to be offered more sustainable treatments and this will also apply pressure to HCPs, providers and payers to respond to this.

With the ending of exclusivity for blockbuster biologics extending well into the 2030s, there is still a long runway for the launch of new biosimilars and the likelihood of changes in the market drivers that will favour more sustainable delivery devices. Furthermore, clearer evidence may well start to emerge around the value of more personalised devices and connected health in improving healthcare outcomes and efficiency – that will then drive interest in connected delivery devices. If progressive biosimilar companies seek to remain in the vanguard of the sector and achieve competitive advantage in crowded markets, they will do well to look beyond current drug delivery device technology and look to capitalise on the benefits offered by more innovative delivery solutions such as smart autoinjectors.

REFERENCES

- Moorkens et al, “The Expiry of Humira® Market Exclusivity and the Entry of Adalimumab Biosimilars in Europe: An Overview of Pricing and National Policy Measures”. Front Pharmacol, 2021, Vol 11, 591134.

- “US Biosimilars Market Size, Share and COVID-19 Impact Analysis, By Drug Class (Filgrastim & Pegfilgrastim, Monocloncal Antibodies, and Others), By Disease Indication (Cancer, Autoimmune Diseases {Arthritis, Psoriasis, Neutropenia, and Others}, and Others), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies), and Regional Forecast, 2022-2029”. Research Report, Fortune Business Insights, May 2022.

- “2021 Biosimilar Trends Report”. Report, Amgen, Jul 2021.

- Limmroth V et al, “The BETACONNECT™ system: MS therapy goes digital”. Neurodegener Dis Manag, 2018, Vol 8(6), pp 399–410.

- Boeri M et al, “From drug-delivery device to disease management tool: a study of preferences for enhanced features in next-generation self-injection devices”. Patient Prefer Adherence, 2019, Vol 13, pp 1093–1110.

- Bittner B et al, “Connected drug delivery devices to complement drug treatments: potential to facilitate disease management in home setting”. Med Devices (Auckl), 2019, Vol 12, pp 101–127.

- Simpson I, “The New Emerging Needs Driving Autoinjector Development”. ONdrugDelivery, Issue 113 (Oct 2020), pp 20–24.

- Byun HG et al, “Budget Impact Analysis of the Introduction of Subcutaneous Infliximab (CT-P13 SC) for the Treatment of Rheumatoid Arthritis in the United Kingdom”. Appl Health Econ Health Policy, 2021, Vol 19(5), pp 735–745.

- Thakur K et al, “Perceptions and Preferences of Two Etanercept Autoinjectors for Rheumatoid Arthritis: A New European Union- Approved Etanercept Biosimilar (Benepali®) Versus Etanercept (Enbrel®) – Findings from a Nurse Survey in Europe”. Rheumatol Ther, 2016, Vol 3(1), pp 77–89.

- Burnard P et al, “Analysing and presenting qualitative data”. British Dental Journal, 2008, Vol 204(8), pp 429–432.

- “Adalimumab, etanercept, infliximab and abatacept for treating moderate rheumatoid arthritis after conventional DMARDs have failed”. Guidance, NICE, Jul 14, 2021.

- “Asthma: diagnosis, monitoring and chronic asthma management”. Guidance, NICE, Updated Mar 22, 2021.

- “Remsima (infliximab biosimilar) for subcutaneous injection for managing rheumatoid arthritis”. Evidence Summary, NICE, July 21, 2020.

- Mansell D, “Biosimilar Development – Guidance on Biosimilar Interchangeability: The Debate Over Drug Delivery Devices”. Drug Dev Del, April 2021 (Vol 21(3)), pp 29–31.

- Thakur K et al, “Perceptions and Preferences of Two Etanercept Autoinjectors for Rheumatoid Arthritis: A New European Union- Approved Etanercept Biosimilar (Benepali®) Versus Etanercept (Enbrel®) – Findings from a Nurse Survey in Europe”. Rheumatol Ther, 2016, Vol 3(1), pp 77–89.

- Hensher M, McGain F, “Health Care Sustainability Metrics: Building A Safer, Low-Carbon Health System”. Health Aff (Millwood), 2020, Vol 39(12), pp 2080–2087.