To Issue 159

Citation: Klein M-C, Weyler C, “Towards a Comprehensive Sustainability Strategy”. ONdrugDelivery, Issue 159 (Apr/May 2024), pp 58–60.

Marie-Christine Klein and Christian Weyler, look at the evolution of the company’s sustainability strategy within its regulatory and economic framework – and what decarbonisation means for the pharmaceutical industry.

In 2004, the UN and Switzerland initiated “Who Cares Wins” to increase understanding and awareness of environmental, social and governance (ESG) topics. ESG considerations revolving around environment, social and corporate governance are at the centre of today’s sustainability efforts.

Although the overall intention is clear, the detailed analysis of what ESG means to different industries and companies and their individual impact is highly diverse. The global urge for decarbonisation is another part of the puzzle for a holistic approach of integrating sustainable thinking. Two hundred countries willing to take responsibility and to unite in the striving for limiting global warming to 1.5°C in the Paris Agreement of 2015 set limiting greenhouse gas (GHG) emissions as a primary goal. The Greenhouse Gas Protocol (GHGP) defines different scopes of GHG emissions, which become prominent vocabulary for companies engaging in emission analysis and reduction targets.

“Identifying decarbonisation potential and ultimately finding their green identity will be a prerequisite for any company’s success in the future.”

Scope 1 refers to the direct emissions from a company’s owned or controlled sources, such as on-site energy. Scope 2 describes indirect emissions from purchased or acquired energy, such as electricity, steam, heat or cooling. It is generated off-site and consumed by a company. Last, but not least, indirect emissions from purchased or acquired energy that is generated and consumed off-site constitutes Scope 3. Different industries are often characterised by the relative impacts of Scope 1, 2 and 3 emissions and their contributions to individual carbon footprints. The health industry is characterised by an especially large relative portion of Scope 3 emissions. This is challenging because these emissions are both outside the direct control of a company and, at the same time, highly relevant.

The EU’s Green Deal concept of 2019 set the goal of becoming the first climate-neutral continent by 2050. It bundles initiatives and laws that will frame the economic industrial landscape of the next decades. Identifying decarbonisation potential and ultimately finding their green identity will be a prerequisite for any company’s success in the future. In line with this, reporting obligations focusing on sustainability matters are constantly growing. The non-financial reporting directive requires numerous large companies with more than 500 employees to include a non-financial statement in their consolidated management report. This directive, which has been in force since 2014, compels the companies concerned to report on sustainability issues. The new corporate sustainability reporting directive, as detailed by the European Sustainability Reporting Standards, extends these reporting requirements to smaller companies.

As a consequence, a steadily growing number of enterprises in the pharmaceutical industry have already started their journey into a more sustainable production chain. They are defining their ESG targets and actively taking part in initiatives such as the Pharmaceutical Supply Chain Initiative. Besides all the legal requirements, environmental sustainability, as well as visible proof thereof, is an increasingly relevant factor in product marketing. Customers are looking for sustainable products.

DECARBONSATION METHODS

Having an established value chain in the pharmaceutical industry means that an extensively regulated environment prevents the swift adaptation of any part of the process. For example, ecologically friendly packaging solutions or exchange of raw materials to reprocessed sources is often hardly possible. Such modifications lead to an altered risk and safety profile, which impacts all stages of product development as well as regulatory compliance. Moreover, with the majority of the emissions anchored in Scope 3, a whole supply chain – ranging from the raw materials and the production and distribution through to consumer use and disposal – contributes to the carbon footprint. Hence, improvements are no low-hanging fruits. Additionally, what became clear during the covid-19 pandemic, was the vulnerability of global pharmaceutical supply chains. These do not have the same potential to transition to a circular economy and reverse supply chain networks as other industries in which purity is not as significant as in pharma.1

A study of the 20 largest pharmaceutical companies shows their major success in reducing Scope 1 and Scope 2 emissions by focusing on energy consumption and company-owned vehicles. Of course, reducing activities of Scope 3 is connected with a large variety of measures and, overall, this scope was reported less often. Of note, suppliers are encouraged to disclose their sustainability efforts (e.g. through EcoVadis) as the information is becoming increasingly important for the selection of suppliers. This is a part of the puzzle, which will affect a lot of participants of the supply chain.2 Moreover, a clear commitment to aligned reporting standards or initiatives is common within the big players – for example, the GHGP Corporate Accounting and Reporting Standard and the Carbon Disclosure Project.2

“The ad hoc change of raw materials is not always a realistic goal,

and even goods that can be produced from recycled materials require energy to be produced.”

What we learn from this overview is that reducing Scope 3 emissions will be the biggest challenge for most players in the pharmaceutical industry. A significant part of taking responsibility is to critically analyse what can be done in the current set-up and what are the next steps to reach the overall goal of reducing emissions as far and as soon as possible. As a prerequisite, knowledge of the whole supply chain and the correct assignment of the different emission categories is the first step. This systematic analysis will lead to quantification of CO2 emissions along the supply chain and, based on that, an individual reduction strategy can be established.

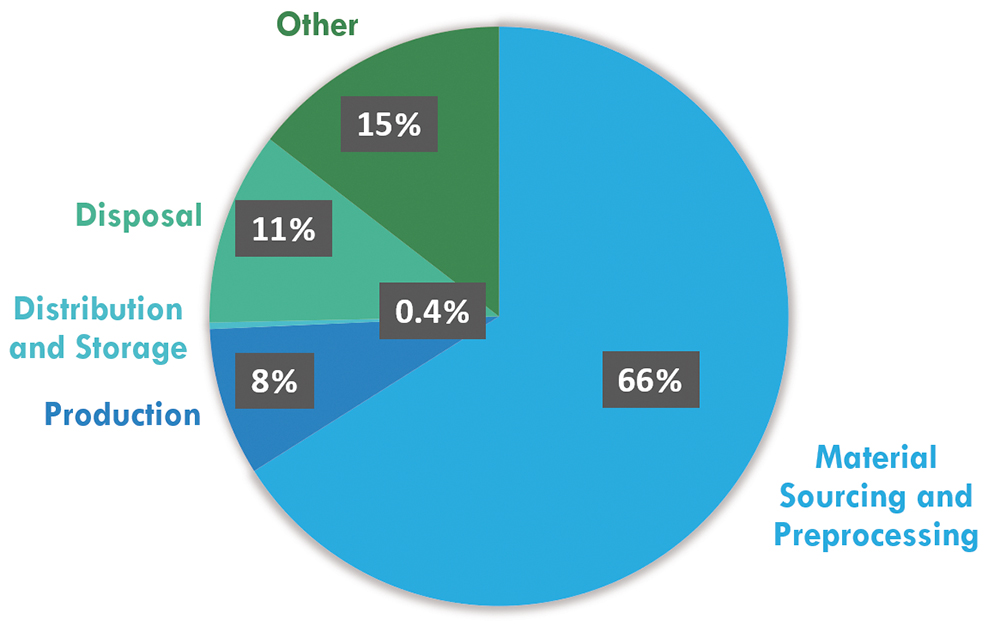

Figure 1: Distribution pattern of CO2 emissions during the lifecycle of a 3K system.

Figure 1 depicts the analysis of the supply chain emissions of the 3K system nasal spray by URSATEC. As expected, the largest CO2 footprint is ascribed to material sourcing and pre-processing activities. These activities encompass incoming raw materials, their incoming logistics, including packaging materials and the distances that need to be overcome to reach the production site. Based on this, several conclusions can be drawn:

- Scope 3 upstream emissions should be targeted to achieve emission reductions. As outlined above, the ad hoc change of raw materials is not always a realistic goal, and even goods that can be produced from recycled materials require energy to be produced. Also, the entire supply chain requires a substantial logistics effort. Hence, products cannot be “climate neutral” or “100% sustainable”.

- To further attenuate the environmental impact of products, there are options to couple the production chain – which is inherently environmentally harmful – to compensation projects. Such compensation projects can be either local/regional or they can be set up to make a substantial difference in a remote part of the world. At first sight, planting anything from a few trees to an entire forest in the direct vicinity of the production site appears to be an ideal and very visible measure to account for the environmental impact of the production chain. However, such projects are not well suited to counterbalance large productions and their emissions.

- Emissions caused by supply chain logistics can be limited by setting up the production as locally as possible. With a European (mainly Germany-based) partner network, URSATEC is in a position to start from a low level of carbon burden within the product carbon footprint.

- To make the sustainability strategy (Figure 2) accessible, visible and understandable throughout 360° of the value chain, disclosing activities and taking part in initiatives is common practice. Moreover, in the near future, URSATEC will add the option of a financial contribution to certified climate protection projects to its product portfolio. This way, the customer can choose to contribute to further reducing the product carbon footprint (PCF). The goal, besides raising customer awareness, is to be a proactive partner within the supply chains in the pharmaceutical industry.

Figure 2: URSATEC’s sustainability strategy for 2024.

REFERENCES

- Bade C et al, “Sustainability in the pharmaceutical industry – An assessment of sustainability maturity and effects of sustainability measure implementation on supply chain security”. Corp Soc Resp Env Ma, 2024, Vol 3(1), pp 224–242.

- Booth A et al, “Pharmaceutical Company Targets and Strategies to Address Climate Change: Content Analysis of Public Reports from 20 Pharmaceutical Companies”. Int J Environ Res Public Health, 2023, Vol 20(4), p 3206.