To Issue 168

Citation: Oakley T, “Drug Delivery Trends for 2025″. ONdrugDelivery, Issue 168 (Jan 2025), pp 18–21.

Tom Oakley and Alex Vasiev look back at how the trends anticipated for 2024 played out in reality and look forward to four major trends expected to influence the drug delivery industry in 2025.

2024 TRENDS IN REVIEW

At the start of 2025, the drug delivery device industry is larger and more innovative than ever. In the “Drug Delivery Trends for 2024” article in ONdrugDelivery’s January 2024 issue one year ago,1 we identified five key trends for the past year:

- The booming market for weight-management drugs

- Closed-loop insulin systems (artificial pancreases)

- Large-volume injection

- Ophthalmic injections

- New development budgets for 2024.

Sales of weight management drugs, led by glucagon-like peptide-1s (GLP-1s) such as Wegovy (semaglutide, Novo Nordisk) and Zepbound (tirzepatide, Eli Lilly), have indeed increased substantially from around US$40 billion (£31.8 billion) in 2023 to around $53 billion in 2024. Growth is expected to continue in the region of 16% to 18% annually.2 The $16.5 billion acquisition of Catalent by Novo Holdings (Dartford, UK) in February 2024 caused shockwaves through the drug delivery industry as fill-finish and injection device manufacturing capacity became saturated.3 This trend shows no signs of slowing but will change significantly as semaglutide’s core patents expire in various countries in 2026.

Closed-loop insulin systems continue to innovate, with the Omnipod 5 (Insulet, Acton, MA, US) pump able to integrate with the FreeStyle Libre 2 (Abbott Diabetes Care, Chicago, IL, US) or Dexcom G6 (DexCom, San Diego, CA, US) continuous glucose sensors4 and the t:slim X2 (Tandem Diabetes, San Diego, CA, US) integrating with the FreeStyle Libre 2.5

Meanwhile, new options for large-volume injections continue to emerge, such as 5 mL autoinjectors. Additional ophthalmic injector development demand continues to be high, but the innovative projects in this area remain confidential.

Finally, anecdotal evidence suggests that new development budgets increased substantially in 2024. As predicted, many major pharmaceutical and medical device companies emerged from their corrections after the significant investments made in the industry during the covid-19 pandemic, multinational supply chains adjusted to new geopolitical realities and interest rates reduced throughout the year, thus freeing up capital for investment.

2025 TREND 1: EMERGENCY COMBINATION PRODUCTS

Many people think of EpiPen from Viatris when emergency medication is mentioned. EpiPen contains adrenaline (epinephrine) to treat anaphylaxis, which can be life threatening. However, some patients and caregivers delay or do not administer treatment in an emergency due to fear of the needle, lack of portability or, for untrained users, fear of giving an injection, among other reasons.6 The first nasal adrenaline for anaphylaxis was approved in Europe in June 2024, and the US in August 2024.7 The product is called EURneffy in Europe and neffy in the US (ARS Pharmaceuticals, San Diego, CA, US). We look forward to other emergency drugs being delivered through new administration routes or using new and improved delivery devices.

Regulatory guidance for emergency combination products is evolving. In April 2020, the US FDA released draft guidance on “Technical Considerations for Demonstrating Reliability of Emergency-Use Injectors Submitted under a BLA, NDA or ANDA”. This draft guidance is being used for developing devices that are injectors or use different routes of administration.

“Emergency devices are typically single use, so a six-figure number of tests is commercially impractical. Therefore, advanced device development and statistical expertise are needed to justify confidence to the 5 Nines level.”

The draft guidance contains the “5 Nines” rule, wherein it “recommends that emergency-use injectors include design control specifications for successful injection reliability of 99.999% with a 95% level of confidence.” If taken literally, this would mean that a development programme would have to test nearly 300,000 devices with zero failures. Emergency devices are typically single use, so a six-figure number of tests is commercially impractical. Therefore, advanced device development and statistical expertise are needed to justify confidence to the 5 Nines level.

2025 TREND 2: REUSABLE DRUG DELIVERY DEVICES

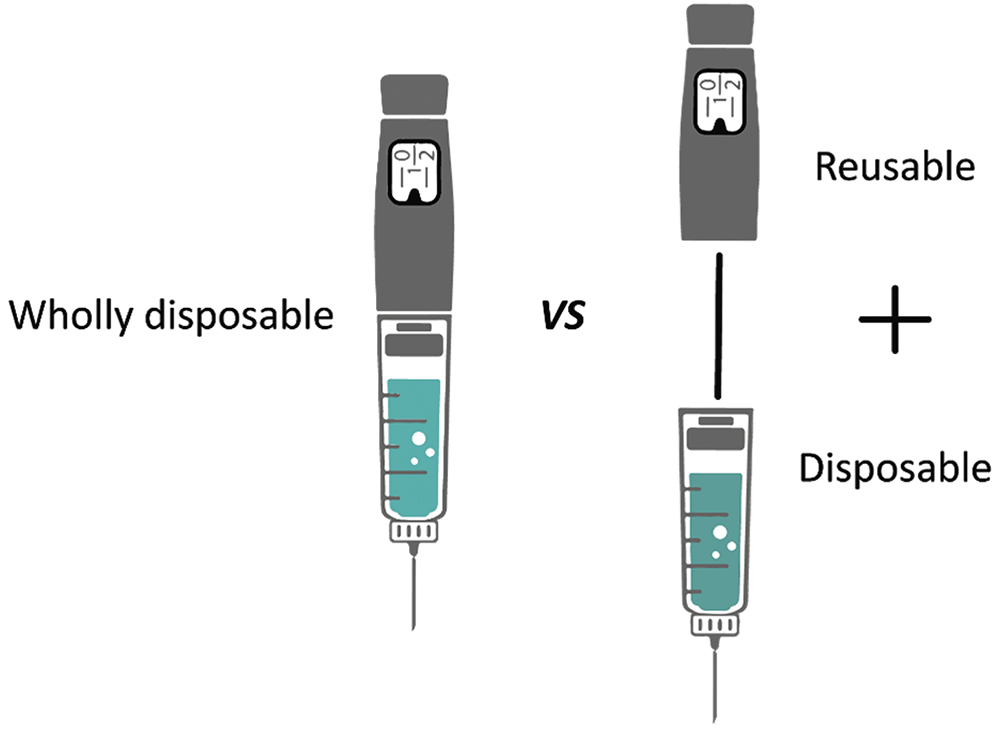

Many drug delivery devices can be developed as either disposable or part-reusable (Figure 1). In our “Drug Delivery Device Trends for 2022” article,8 we identified a trend whereby pioneering devices tend to be partly reusable, and then wholly disposable versions appear and take some of the market. Many of the devices in development indicate that there is renewed interest in reusable devices. Drivers for this trend are likely to include the following:

- Patients and other stakeholders are becoming increasingly sensitive to the environmental impact, especially from plastic waste, of fully disposable devices.

- The current generation of devices tends to be more complicated and costly than the previous generation. For example, on-body injectors are likely to have more components and mechanisms, and therefore have a higher built-in cost than prefilled syringes, safety systems and autoinjectors. The economics of fully disposable devices sets an upper limit on their cost.

- Many new devices have a “connectivity” aspect. The electronics and batteries that are typically involved in these features lend themselves to reusable modules.

Figure 1: A disposable versus part-reusable injection device.

Example reusable autoinjectors that have been announced recently include:

- The Elexy reusable autoinjector from SHL Medical

- The Aria reusable autoinjector from Phillips Medisize

- AstraZeneca’s reusable autoinjector.

Reusable injection devices from earlier years include easypod/RebiSmart from Merck Group, AutoTouch from Amgen, and ava from UCB Biopharma (Brussels, Belgium).

2025 TREND 3: RENEWED INTEREST IN GAS-POWERED INJECTORS

Development of new biologics, particularly monoclonal antibodies, is leading to demand for injection devices capable of handling increased volumes and viscosities. Most commercial autoinjectors are driven by a mechanical (typically stainless steel) spring. However, compressed or liquefied gas canisters can provide higher energy densities than springs. As such, several companies have developed gas-powered autoinjectors, with current examples including:

- The Aerio range from Kaléo

- ZENEO from CrossJect

- LVDC from Windgap Medical

- AltaVISC from Altaviz

- The Congruence Autoinjector from Congruence Medical

- Bios from SMC.

This is not an exhaustive list of the gas-powered injectors in development, and several have ceased development, such as Syrina by Bespak. The clear trend is that many device companies are betting on gas power as their future platform for high-viscosity and/or high-volume injections.

2025 TREND 4: REDUCED INJECTION SITE PAIN

Patient adherence remains a critical challenge in the management of chronic conditions, with injection site pain (ISP) playing a significant role in non-compliance.9 ISP is a multifaceted issue influenced by environmental factors,10 patient physiology, and the characteristics of formulations and delivery devices. Formulations often include excipients – such as buffering agents, tonicity adjusters, bulking agents, surfactants and preservatives – essential for maintaining the stability of complex and fragile therapeutics. However, these excipients may inadvertently contribute to ISP. Similarly, device characteristics, including needle geometry and delivery rate, significantly impact the level of pain perceived by patients during administration. Addressing these factors is critical for improving patient experience and adherence.

The introduction of innovative adjuvants, such as hyaluronidase, represents a breakthrough in reducing ISP, particularly for larger-volume formulations. These adjuvants facilitate more tolerable delivery and their adoption has gained momentum, including the FDA’s recent approval of VYVGART Hytrulo by Argenx (Boston, MA, US) in 2024. This development sets the stage for broader use of adjuvants in 2025 and beyond.11

Autoinjectors, such as the YpsoMate 2.25 (Ypsomed), will use syringes featuring short, ultra-thin needles specifically designed for high-viscosity formulations,12 with the announcement of a collaboration with BD on integration of the Neopak™ XtraFlow™ system.13 This trend is expected to expand into broader applications and other primary packaging systems intended for subcutaneous delivery.

There has also been a sustained adoption of on-body devices that, among other things, achieve slow injections, which inherently limits ISP:

- The UDENCYA ONBODY™ Injector by Coherus BioSciences (Redwood City, CA, US) was approved by the FDA in December 2024.14 This device delivers a pegfilgrastim biosimilar for treating neutropenia competing with Amgen’s Neulasta Onpro.

- The enFuse onbody injector from Enable Injections has been approved for Apellis Pharmaceuticals’ (MA, US) EMPAVELI (pegcetacoplan), providing a self-administration option for patients needing high-volume subcutaneous injections. Development agreements between Enable Injections and companies such as Sobi (Waltham, MA, US) may lead to more of these devices reaching the market.15

“Advances in injection technologies, from innovative adjuvants to cutting-edge device designs, can reduce ISP and thereby reduce one of the key barriers to higher patient adherence.”

Advances in injection technologies, from innovative adjuvants to cutting-edge device designs, can reduce ISP and thereby reduce one of the key barriers to higher patient adherence. We expect an increased adoption of new technologies through 2025 across a broader range of formulations and therapeutic areas.

SUMMARY

The weight-management drug market continues to boom and new closed-loop insulin systems continue to come to market. There has also been progress in large-volume injectors and ophthalmic injectors. There are signals that the development budgets for drug delivery devices increased in 2024 over 2023 as predicted.

Those trends are likely to continue and, to those, we have added the following predictions for 2025:

- Increased interest and use of new emergency combination products

- Increasing development of reusable drug delivery devices

- Renewed interest in gas-powered injectors

- Developments in low pain drug delivery.

REFERENCES

- Oakley T, de Silva K, “Drug Delivery Trends for 2024”. ONdrugDelivery, Issue 156 (Jan 2024), pp 14–17.

- “The growing market for GLP-1 drugs”. Macquarie Asset Management, Oct 2024.

- “Novo Holdings to Acquire Catalent”. Press Release, Catalent, Feb 2024.

- “Omnipod 5 can now connect with the new Freestyle Libre 2 Plus sensor”. Diabetes UK, Jun 2024.

- Reuter E, “Abbott, Tandem launch new hybrid closed-loop insulin delivery system”. Medtech Dive, Jan 2024.

- “First nasal adrenaline spray for emergency treatment against allergic reactions”. EMA, Jun 2024.

- “FDA Approves First Nasal Spray for Treatment of Anaphylaxis”. US FDA, Aug 2024.

- Oakley T, “Drug Delivery Device Trends for 2022”. ONdrugDelivery, Issue 129 (Feb 2022), pp 12–14.

- Taghizadeh B, Jaafari MR, Zargham N, “New insight into the importance of formulation variables on parenteral growth hormone preparations: potential effect on the injection-site pain”. Front Endocrinol (Lausanne), 2022, Vol 13, article 963336.

- Yip L, Oakley T, “The final frontier to improving low-pain injections”. Springboard, Jan 2024.

- Becker Z, “Argenx widens its Halozyme Therapeutics-partnered net with 4 new targets in $30M license expansion”. Fierce Pharma, Oct 2024.

- Fontanellaz T, Jost R, Schneider S, “Subcutaneous Drug Delivery: Adapting to High-Viscosity, Large-Volume Demands”. ONdrugDelivery, Issue 166 (Oct 2024), pp 8–12.

- “BD and Ypsomed Collaborate to Advance Self-Injection Systems for High Viscosity Biologics”. Press Release, Press Release, BD, Oct 2024.

- Mehr S, “FDA Hands Coherus Approval for Udenyca® Onbody™ Injector”. BR&R, Jan 2024.

- “Enable Injections Announces Agreement with Sobi® to Develop and Distribute Aspaveli® in Combination with enFuse® in Sobi Territories”. Press Release, Enable Injections, Sep 2024.