Citation: Shur J, “Exploring a Faster, More Cost-Effective Alternative to Generic Bioequivalence”. ONdrugDelivery Magazine, Issue 102 (Nov 2019), pp 10-12.

Jag Shur explores the challenges companies face in bringing generic respiratory and nasal therapies to market – and how some organisations have proactively addressed the challenge and developed services to integrate the device and the formulation, introducing the Aptar Pharma Services offering.

Whether you are a large pharmaceutical company with access to knowledge space at every point of the drug development cycle, or a smaller company with a particular specialism, time to market will be a key driver.

The challenge is how to accelerate development time, while at the same time de-risking the opportunity. And, of course, ensuring that costs don’t escalate. This challenge is particularly evident in the respiratory and nasal therapeutic areas where the complexity of the development and regulatory approval process places a significant financial and regulatory burden – especially on those developing generic formulations.

A CHANGING REGULATORY LANDSCAPE

“We are witnessing an escalation in the complexity of the registration process and a heightened focus on device technology and patient safety.”

The US FDA requires comparative clinical endpoint bioequivalence (BE) studies in its weight-of-evidence approach for an abbreviated new drug application (ANDA) of all orally inhaled and nasal drug products (OINDPs). This requires a lengthy and costly clinical trial, with often unpredictable results.

In fact, Datamonitor suggests it costs more than $100 million (£79 million) to bring any AB rated (drugs that have been proven to meet the necessary bioequivalence requirements through in vivo and/or in vitro testing compared with a reference standard that is currently approved) inhaled drug to the US market. The cost of a single, 900+ person clinical endpoint BE study is circa $45 million. These studies typically have high variability and low sensitivity, and cannot detect any formulation differences between test and reference products. They really only confirm local equivalence.

For this reason (in its own words) “even though there is a current, clear regulatory pathway utilising the weight-of-evidence approach for BE assessment of OINDPs”, the US FDA’s Office of Generic Drugs (OGD) continues to explore new methods to make development and BE assessment of OINDPs more cost and time effective in the future.

In May 2019, the FDA provided an alternative pathway for an ANDA submission of a solution metered dose inhaler (MDI). This alternative will decrease programme costs by about 45% and increase the net present value of respiratory genericproducts. Currently there are 26 FDA product specific guidances for OINDPs. Removing clinical endpoint BE studies for OINDPs could save $5 billion over time.

THE VALUE OF AN INTEGRATED APPROACH

We are witnessing an escalation in the complexity of the registration process and a heightened focus on device technology and patient safety from regulatory bodies. This, coupled with the loss of technical skills in some large pharma, and the lack of expertise in smaller pharma companies, has resulted in a gap in the analytical capabilities required to accelerate and de-risk drug development.

“The key element… is to find an alternative BE clinical endpoint approach for OINDPs.”

There is a growing desire to develop both new and generic OINDPs, and so the need for pharma partners to be able to support customers during the entire life cycle of the drug product and deliver them a complete solution is clear. In response to our partners’ needs, we have developed Aptar Pharma Services. This offer builds on Aptar Pharma’s established credentials of >25 years of manufacturing excellence and a wide portfolio of solutions and services, now complemented with the expertise of Aptar-acquired Nanopharm, Next Breath and Gateway Analytical, to provide that complete solution.

The Aptar Pharma Services model is a novel example of how partners are responding to the market need for accelerated device and finished drug product development, while at the same time mitigating risk and reducing cost. Consisting of four complementary, value-added and differentiated analytical, testing and development services, the model enables Aptar Pharma to collaborate earlier with customers to support their complex drug formulations and delivery requirements at all stages of drug development and commercialisation.

The four components are:

- Aptar Pharma – a global provider of drug delivery systems and services

- Next Breath – a full-service cGMP lab specialising in analytical testing of drug delivery systems

- Gateway Analytical – a leader in the testing of injectable drugs, providing particulate detection and predictive analytical services

- Nanopharm – a provider of orally inhaled and nasal drug product design and development services.

WHAT ALTERNATIVES ARE AVAILABLE TO FAST TRACK GENERIC BE STUDIES?

So far, we have established that the challenge is how to accelerate development time, while at the same time de-risking the opportunity for failure and managing cost. The key element in that trifecta of challenges is to find an alternative BE clinical endpoint approach for OINDPs.

One option is Nanopharm’s SmartTrack™ process, which combines the recording of inspiratory breath profiles with realistic aerodynamic particle size distribution performance testing. Using representative mouth-throat models, in vitro dissolution and morphology directed particle sizing, chemical imaging of a representative lung dose and regional deposition modelling, together with physiologically based pharmacokinetic models for predicting local and systemic exposure, SmartTrack provides the critical elements required to meet the alternative requirements and eliminate clinical endpoint BE studies.

ACCELERATING AND DE-RISKING GENERIC PRODUCT DEVELOPMENT

SmartTrack uses methodologies to bridge in vitro measurements and in vivo performance of OINDPs through clinically relevant mouth-throat models, dissolution, advanced in silico modelling and simulation tools. Using its proprietary aerosol collection apparatus (UniDose), Nanopharm investigates the in vitro dissolution, formulation microstructure and realistic aerodynamic particle size distribution performance of generic and reference products with representative mouth-throat models. These data, with realistic breathing profiles, are employed in an in silico regional deposition model with physiologically based pharmacokinetic simulation of local and systemic exposure.

Such novel in vitro techniques have been used to predict the local extent and rate to which the active drug from OINDPs is absorbed and becomes available at the site of therapeutic action. SmartTrack has proved indispensable in guiding product development programmes, local bioavailability and BE assessment of OINDPs, as well as in supporting regulatory decision making.

ACCELERATING OINDP DEVELOPMENT

When predicting clinical outcomes, aerosol delivery – including emitted dose, fine particle mass and aerodynamic particle size distribution – from a dry powder inhaler (DPI) is largely determined by the interaction between the device, formulation and inhalation manoeuvre.

The SmartTrack process with an inhalation flow profile (NIP) device enables real-time measurement of patients’ inspiratory flow profiles – and measurements of their initial acceleration at the beginning of inhalation, peak inspiratory flow, total inhaled volume and airpower. These profiles, with clinically relevant mouth-throat and nasal models, show good in vivo correlations in predicting regional drug deposition and systemic exposure.

With real-time feedback, NIP has been successful in clinical PK studies, training patients and gathering inhalation profile data of patients during different arms of a longitudinal, crossover clinical trial for soft mist inhalers, MDIs and DPIs.

Nanopharm has pioneered the concept of structural Q3 equivalence for OINDPs. This approach is vital for the industry. SmartTrack is guiding alternatives for inter-product comparisons that support clinical endpoint biowaivers for OINPD development programmes, bringing cost-effective generic medications more quickly to market (Figure 1).

WHAT BENEFITS ARE THERE FROM THIS ALTERNATIVE APPROACH?

For pharma companies, this delivers a unique, holistic approach to predicting clinical outcomes, at a fraction of the time and cost of conventional approaches. It enables experts to speak to experts, creating a partner approach that is committed to good outcomes. It also provides for a backstop in the event internal resource becomes an issue. Finally, it provides choice and an awareness of delivery options that may not be available in-house.

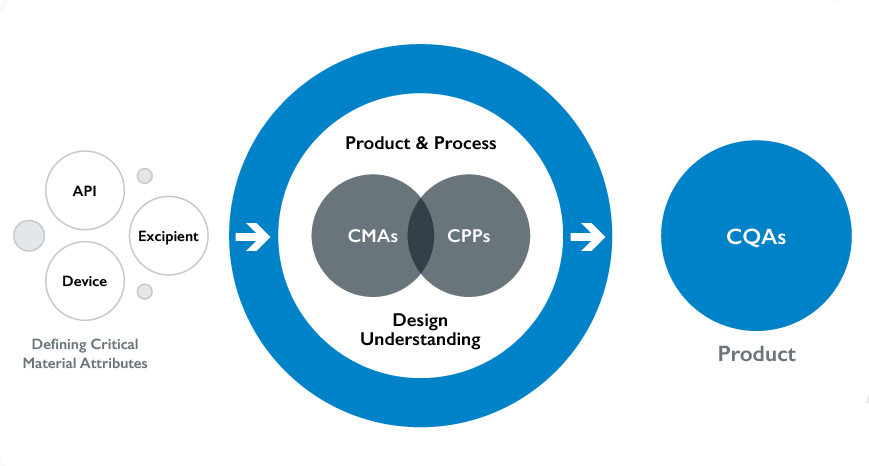

Figure 1: Nanopharm offers an integrated solution approach via SmartTrack.

Rationally, the benefits are wide ranging. An alternative to clinical endpoint BE dramatically decreases programme costs by up to 45% and increases the net present value of respiratory generic products. It provides significant opportunities for the FDA and generic sponsors to realise the efficient approval of OINDP generics. Ultimately, reduced development time and cost inevitably provides companies with a clear and compelling competitive advantage over those who pursue the conventional BE study route.

“An alternative to clinical endpoint BE dramatically

decreases programme costs by up to 45% and increases

the net present value of respiratory generic products.”

This approach also means access to more affordable medicines, faster for many more patients.

CONCLUSION

Companies need to spend in excess of $100 million to bring any generic (AB rated) inhaled drug to the US market. The cost of a clinical endpoint BE study could be up to $45 million – with little valuable data at the end of it. The time (up to six months per study) and cost required to follow the FDA’s weight-of-evidence approach for an ANDA of all OINDPs could preclude many generic respiratory, oral or nasal therapies ever reaching the market.

But there is a smarter, faster, cheaper, quicker, approved way. Offers such as SmartTrack, from Nanopharm, provide the critical elements required to meet the alternative requirements and eliminate clinical endpoint BE studies, accelerating and de-risking generic product development. The outcome for organisations is a clear competitive advantage over rival companies.

The outcome for patients and public health organisations is access to therapies faster and at a reduced cost.

As with all innovation, the job doesn’t stop there. There are many novel developments in compliance and adherence that are being considered for this smart way of studying efficacy. And the scientists at Nanopharm are already working on alternative bioequivalence studies for delivery to the lung and nose systems for systemic delivery of higher payloads.

This journey is fascinating, exciting and full of opportunity.