Citation: Sehlstedt U et al, “Transforming Healthcare – How Curative Therapies Will Disrupt the Market. ONdrugDelivery Magazine, Issue 103 (Dec 2019), pp 43-46.

Ulrica Sehlstedt, Craig Wylie, Thomas Unger, Rebecka Axelsson Wadman, Vikas Kharbanda, and Satoshi Ohara, all members of the Healthcare and Life Sciences Practice of Arthur D. Little, explain how the shift to curative treatments promises to transform the entire healthcare ecosystem.

The combination of scientific advances, increasing patient expectations, the emergence of new technologies and growing concerns around cost are driving an unprecedented level of change encompassing whole healthcare systems across the globe.

“The first mover can effectively eliminate any market opportunities for competitors by curing the backlog of patients either waiting for treatment or receiving chronic care. The only remaining need will then be from newly diagnosed patients..”

One key part of this is the shift towards curative treatment for conditions that were previously considered chronic or untreatable. Essentially, patients who previously had to rely on ongoing medication can now be cured through a specific, time-limited course of treatment which transforms their lives.

But this will disrupt the entire healthcare ecosystem. With curative treatments, payers’ expenditure drastically shifts from ongoing, long-term and relatively low-cost drugs to large, front-loaded therapy costs. Revenues for therapy providers will also shift, focusing on when they are introduced to the market. This transformation will lead to a number of consequences for patients, policy makers, payers, providers and pharma companies alike.

WHAT ARE CURATIVE THERAPIES?

Our definition of a curative therapy is a time-limited treatment that removes the symptoms of a disease through permanent (or semi-permanent) correction of the underlying condition. In contrast, a pill that a patient needs to take for the rest of their life to manage symptoms or disease progression is not curative.

From our analysis, we have defined three archetypes of curative treatments:

- Biology-modifying drugs – a good example of this is Gilead Sciences’ hepatitis C virus (HCV) treatment Sovaldi (sofosbuvir) (Box 1)

- Gene therapy – this addresses underlying causes of a disease by correcting the missing or mutated genes. It can be divided into somatic and germ-line therapy, with the latter treatment curing not only the current patient but also their future offspring. Examples include Luxturna (Box 2) from Spark Therapeutic for patients with inherited retinal diseases (IRDs)

- Cell therapies – genetically re-engineering cells, such as CAR-T and stem-cell treatments.

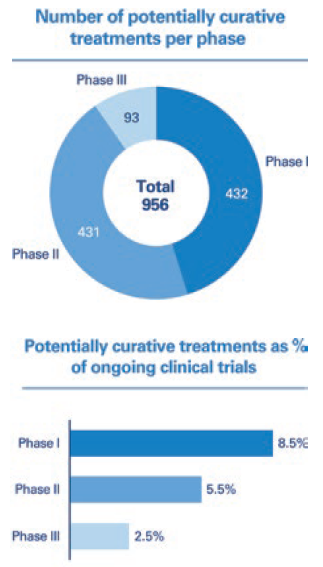

Figure 1: Analysis of clinical trials pipeline of potentially curative therapeutics.

The number of curative treatments is increasing. Analysis of the clinical trials pipeline undertaken by Arthur D. Little shows that approximately 5% of all drugs currently registered as active at ClinicalTrials.gov are potentially curative. The highest share of potentially curative treatments can be observed in Phase I (Figure 1) which indicates that we will see a significant increase in the number of curative treatments reaching the market over the next 10 years.

IMPLICATIONS FOR CARE PROVISION

Curative treatments have the potential to lower the overall impact and cost that particular diseases have on healthcare systems, as they eliminate the need for longterm chronic care. This will change the way we treat patients and impact how healthcare providers organise care and its delivery. The sales and upfront cost profiles of these new treatments will have an immense impact on payers and providers. It will demand the development of new models for payment and reimbursement in order for their introduction to be affordable.

BOX 1: CASE STUDY – SOVALDI

A recent example of the shift in sales patterns is Sovaldi, which was launched in 2013. This is the first curative treatment that effectively cures 99% of HCV cases.

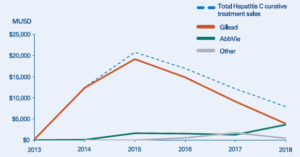

Figure 2: Sales for hepatitis C curative treatments (2013–2018).

When competitors entered the market in 2014, a large share of patients had already been treated. Based on its successful record, Sovaldi was the natural first choice for prescribing to new patients. To demonstrate the importance of first-mover advantage, when AbbVie launched its first hepatitis C drug about 12 months later, sales were disappointing. However, in 2018, it launched a significantly improved followup drug, Mavyret, which is currently the leading treatment for new patients. While this has managed to gain AbbVie a strong long-term market position, the company clearly missed out on the lion’s share of treatment revenues.

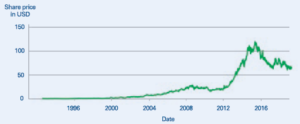

Figure 3: Gilead share price movement.

The unusual sales profile shown in Figure 2 had a clear and unexpected effect on Gilead’s share price (Figure 3). Even though investors understood that Sovaldi was a curative treatment, shareholders weren’t expecting the peak and consequent drop in sales, which led to the share price slumping as sales naturally slowed down. This demonstrates that pharma companies will need to anticipate this issue and either educate the market or, more likely, try to balance product portfolios to counteract potential large swings in sales.

This impact is already being seen. Many one-payer health systems have observed significant increases in drug spending directly attributable to the introduction of Sovaldi, which costs US$84,000 (£65,000) for a three-month course of treatment. For budgetary reasons, the UK NHS tried to delay its availability (along with next-generation therapy Havoni) to patients – and looked to cap the annual number receiving the treatment.

In the US, some state Medicaid programmes and private health insurers restricted access to curative therapies, which has led to warnings from federal officials and lawsuits from patients. Medicaid programmes in 29 states said Sovaldi was the first or second most costly pharma outlay they had to make. While payers recognise that drugs such as Sovaldi lead to bigger medical savings later on – for example, if hepatitis C is left untreated, it can lead to cirrhosis, liver failure or liver cancer – its immediate financial impact has a profound impact on the current budgets of insurers and payers. And this is for a drug that is relatively low cost compared with some curative treatments.

In contrast, imagine the cost and operational impact for a cancer centre if multiple expensive curative treatments were introduced in the same year. This higher variability in costs makes it increasingly difficult to plan and budget – aspects that are key to healthcare systems, given that they are under continuous cost pressure.

IMPLICATIONS FOR PHARMA COMPANIES

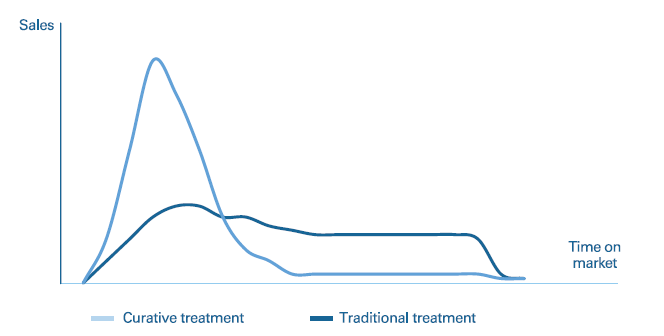

The revenue models for curative treatments are radically different from those for existing drugs. Traditionally, new therapies tend to show a modest bump in sales when introduced, which then stabilises and remains steady until patent expiration. This delivers predictable revenues and requires stable, ongoing drug production.

Curative therapies, however, are one-off treatments. Once a patient has been treated, they will not require any further treatment. That means peak sales will appear earlier and be higher than for traditional therapies, as the populations of eligible patients will all be treated in a short space of time. However, sales will then drop off much faster once this pent-up demand has been met. Figure 4 compares revenues for a traditional therapy versus a curative one.

Figure 4: Revenue curves for traditional versus curative treatments (illustrative).

This new model represents a clear break from typical pharma sales profiles – which will, in turn, impact the way pharma organisations need to be set up and function. Manufacturing needs to be able to deliver large-scale production in the short term but – once the peak has passed – it needs to be scaled down to more modest, “steady-state” production volumes. The same is true for marketing and sales. This also affects competitive products. When there is already unmet demand, the first mover really does have a significant advantage. It can effectively eliminate any market opportunities for competitors by curing the backlog of patients either waiting for treatment or receiving chronic care. The only remaining need will then be from newly diagnosed patients.

BOX 2: CASE STUDY – LUXTURNA

Luxturna (voretigene neparvovec) from Spark Therapeutic is the first US

US FDA-approved gene therapy for patients with IRD caused by mutations in both copies of the RPE65 gene.

- Patients suffering from IRD risk partial or complete blindness and, while current treatments can help slow down the advancement of IRD, they cannot stop disease progression

- Luxturna carries a list price of $850,000 (£660,000) or $425,000 per eye – a high cost for payers to bear despite there being a limited number of patients

- In order to address this, Spark set up a payment agreement with Harvard Pilgrim Health Care – the first health plan to cover the treatment. Under its terms, Harvard Pilgrim Health Care will only need to pay for patients who are successfully treated

- The outcomes-based contract pays Spark in full only if the drug works after 30 months, with an interim payment based on preliminary effects at 30–90 days

- Before being treated, patients need to undergo genetic testing to confirm the gene mutation, and it must be confirmed that the patient has enough viable retinal cells to restore or preserve vision.

KEY FACTORS TO CONSIDER IN ANTICIPATION OF CURATIVE THERAPIES

Curative therapies have the potential to disrupt the healthcare market and, most importantly, to dramatically improve the lives of patients struggling with significant, long-term conditions. In order to control this disruption and maximise their positive impact, a number of questions need to be addressed by treatment providers, care providers, payers and policy makers.

Payers and Policy Makers

In a world of limited resources, tough decisions need to be made. While curative treatments have the potential to reduce costs down the line, they are increasingly expensive, which adds to the accelerating overall cost pressure on healthcare systems. What diseases should be treated over others, what curative treatments should be funded, and for whom? These are ethical questions that need to be answered, and the answers will have significant impact on patients and their health.

The timing of costs also needs to be controlled, with the financial impact of new treatments evened out to reduce cost volatility. There are a number of potential payment model options that could be used, either alone or in combination, to address this:

- Survival/outcomes-based payment – the treatment is only paid for when successful. This shifts part of the risk of unsuccessful treatment to pharma companies, effectively lowering the risk that payers will have to fund both an expensive treatment and continued treatment for a chronic condition

- Interim payments – payments are spread out over longer periods. This aligns the cost profile much more closely to that of a chronic/long-term treatment and reduces the immediate cost for payers

- Companion diagnostic-based payment – treatments are only approved when a companion diagnostic has shown that the patient is highly likely to respond to the treatment. This also serves to limit the number of patients subjected to ineffective treatments, which, by extension, also reduces costs for payers.

If the payer is a private insurance company, its models for calculating risks and costs, as well as for pricing, will need to be changed, as past actuarial data will no longer be accurate. In addition, payers and policy makers will need prior warning when new curative treatments are about to hit the market, so that they have time to accurately plan, budget and adapt policies.

Care Providers

Care providers are facing a multitude of changes due to the increase in curative treatments. They will need to shift their organisations and infrastructure from chronic care and surgery to curative treatments.

Care providers will need to shift their financial models, as well as their operating models, to better account for swift changes in standards of care. A key component here is training of staff – as new treatments are introduced more often and for shorter time spans, training models will need to be adapted to focus on faster learning and higher degrees of staff specialisation.

Pharma Companies

Ensuring first-mover advantage is key for any pharma companies that operate in fields in which curative treatments can potentially be introduced. They need to focus on market intelligence and build portfolio decision-making models that take into account the unique properties of curative treatments.

They will need to understand if the new treatments they are developing are curative, if products being developed by competitors are curative, what their own time to market is, and whether they can gain first regulatory approval and be first on market. If first approval is possible, but they face competition, they should assess how they can accelerate time to market to beat rivals. If first approval is not a possibility, they need to be prepared to significantly revalue potential market revenues, move away from the project, or know for sure that the product is superior to the competition.

Pharma companies also need to rethink their reimbursement models. The greater the certainty that a treatment will be curative, the greater its worth, and this enables it to command higher prices. If a specific patient type is responsive, the company needs to ensure there are diagnostics in place to demonstrate this. It will need to charge more if it knows the treatment is going to work and reduce long-term costs – or leverage the use of contingent payments to allow care providers to pay over time or when results have been achieved. This makes it hard for anyone else to break into the market.

Companies will also require a proactive approach to portfolio management. They must understand the timing of revenues and plan for dealing with revenue cycles that are radically different from the pharma industry standard. Finding a way to balance revenue – either through portfolio management, business/price model changes or financial planning – could help avoid large share-price fluctuations. Factoring companies could become important players in the industry by financing peak manufacturing costs and then taking upfront revenue and paying it out to the pharma company over time, thus helping to manage peaks in costs and revenue.

INSIGHT FOR THE EXECUTIVE

An increase in curative treatments will lead to tremendous clinical progress and drastically improved quality of life for affected patients. It will also, however, put significant pressure on healthcare systems, as well as change revenue models for pharma companies providing such treatments. High initial sales caused by the treatment of large backlogs will lead to distinct first-mover advantages and large fluctuations in production volumes.

To prepare for this major change, there are a number of concrete items that policy makers and executives in the healthcare industry must focus on:

- New payment and reimbursement models need to be put in place. Pharma companies developing curative treatments need to engage with care providers, policy makers and payers to develop financial models that are sustainable for all parties. Engaging with payers and providers early on will also help them plan and prepare for implementation of new treatments. In order for patients to fully benefit from the new developments, healthcare provider operations need to be able to accommodate rapid changes in care practices. Training, education, facilities management and executive decision-making processes will all be impacted.

- Policy makers, payers and care providers should start to build up better analytical capabilities tailored to assessment of new curative treatments and their implications. These must focus on quantifying the value of the new therapies, in terms of both the value to patients (improved quality of life, increased lifespan) and the financial side (the upfront cost of treatment versus the long-term costs of managing the disease, as well as the cost of treating medical issues caused by the disease). Models for quantifying and analysing treatment impact should then be used to make qualified decisions around treatment funding and prioritisation of healthcare spend in order to balance expectations around treatment access with overall cost and value.

- Pharma companies need to review their drug pipelines, portfolio management practices and launch plans (marketing, sales, manufacturing) to accommodate the different properties of curative treatments so that they can proactively push for first-mover position or adapt their strategies if that isn’t possible.

Developing these new capabilities across the healthcare system will be essential to ensure new therapies can be brought to market and implemented in clinical practice in an efficient and sustainable manner – prioritising high-value treatments for the benefit of patients.

Previous article

THE CURRENT STATE OF PLAY IN CONNECTED DEVICESNext article

AN INJECTION OF CONNECTED NEEDLE-FREE INNOVATION