To Issue 159

Citation: Eldridge C, “Pharmaceutical Industry Sustainability Targets, One Year On”. ONdrugDelivery, Issue 159 (Apr/May 2024), pp 28–31.

Catriona Eldridge analyses whether the pharmaceutical industry is meeting its targets and doing enough in the fight against climate change.

In the October 2022 “Drug Delivery & Environmental Sustainability” issue of ONdrugDelivery, Springboard discussed climate-related targets set by 10 major pharmaceutical companies, along with progress towards these targets and their history of meeting previous environmental and climate-related goals.1

“The overall outlook in 2022 was not particularly promising, although there were some successes.”

The overall outlook in 2022 was not particularly promising, although there were some successes. The RE100 and Energize initiatives were increasing the amount of renewable electricity used throughout the value chain, multiple companies were redesigning products, packaging or manufacturing processes to improve efficiency, and some companies had made major commitments to improving their environmental impact.

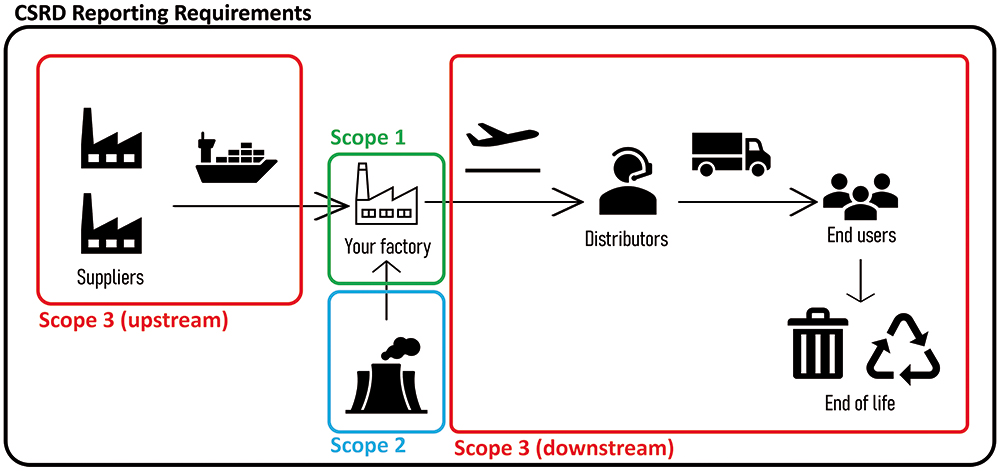

The article analysed the targets set by these companies in Scope 1 and 2, as well as in Scope 3. Scope 1 emissions are produced by a company directly on site, Scope 2 emissions are produced directly in a process the company has paid for (such as generating electricity) and Scope 3 emissions are all the other emissions associated with the value chain of a product.2 Figure 1 illustrates the differences between Scope 1, 2 and 3 emissions. It was found that half of these companies had actually increased their emissions over the previous years, and that the typical yearly reductions, if any, were only 7% (Scope 1 and 2) and 6% (Scope 3). In 2022, according to the latest reports, these companies needed reductions of 15% per year to meet their targets.

Figure 1: Scopes 1, 2 and 3 cover greenhouse gas emissions throughout the entire value chain.

At the time of writing the previous article, COP26, held in 2021 in Glasgow, Scotland, was the largest and most recent global effort in the fight against climate change, which had stimulated the round of target setting seen in 2020. Since then, the Intergovernmental Panel on Climate Change (IPCC) published its sixth Synthesis Report in March 2023,3 laying out a series of future scenarios varying from 1.5°C warming by 2100 to 4.4°C. These scenarios follow from particular pathways for global greenhouse gas emissions; the report states that the best-case scenario (1.5°C) requires global emissions to peak by 2025, drop to zero by the early 2050s and become negative from then on.

The UN has also laid out a roadmap to Net Zero, urging countries, companies and organisations to halve their emissions by 2030 and achieve Net Zero emissions by 2050.4

“Some new targets have been introduced, and others have been adjusted. Generally, where the targets have changed, they have become more ambitious.”

HAS PROGRESS BEEN MADE?

How have the 10 companies fared in the interval? Have their targets changed? What progress have they made?

Some of the earlier deadlines are now approaching, some as soon as 2024 and 2025. As discussed in the previous article, only half of the targets made since 2000 have been successfully met. The remainder were either explicitly missed, or the outcome was not mentioned in the annual company reports.

Since then, some new targets have been introduced, and others have been adjusted. Generally, where targets have changed, they have become more ambitious. This is clearly necessary – of the 25 targets covered last year, only seven were accredited by the Science Based Targets initiative (SBTi) as consistent with a 1.5°C pathway. The SBTi are technical experts, assessing companies’ emissions-reduction plans against a 1.5°C pathway. Only six companies’ targets were consistent with the new UN target of Net Zero by 2050, which would be broadly in line with the IPCC model for limiting the global temperature rise to only 1.5°C. The largest Scope 3 target in 2022 was a 50% reduction. This year, the largest is AstraZeneca’s planned 98% reduction, where the average Scope 3 target is 70%. As of 2024, of the 48 targets found at the time of writing, 23 have been accredited by the SBTi,5 and nine companies have at least some targets aligned with 1.5°C. This is an improvement on 2022.

The deadlines have not yet been reached for most of these targets, but what progress has been made in reducing emissions? Similar to the picture in 2022, companies need to make significant reductions every year between now and their deadlines to meet their targets. The average annual reduction needed is now 11% of current emissions, every year, with some targets requiring reductions as large as 50% year on year. This average is an improvement on 2022, when the average required reduction was 15% per year, although the largest annual reduction required then was 25%.6

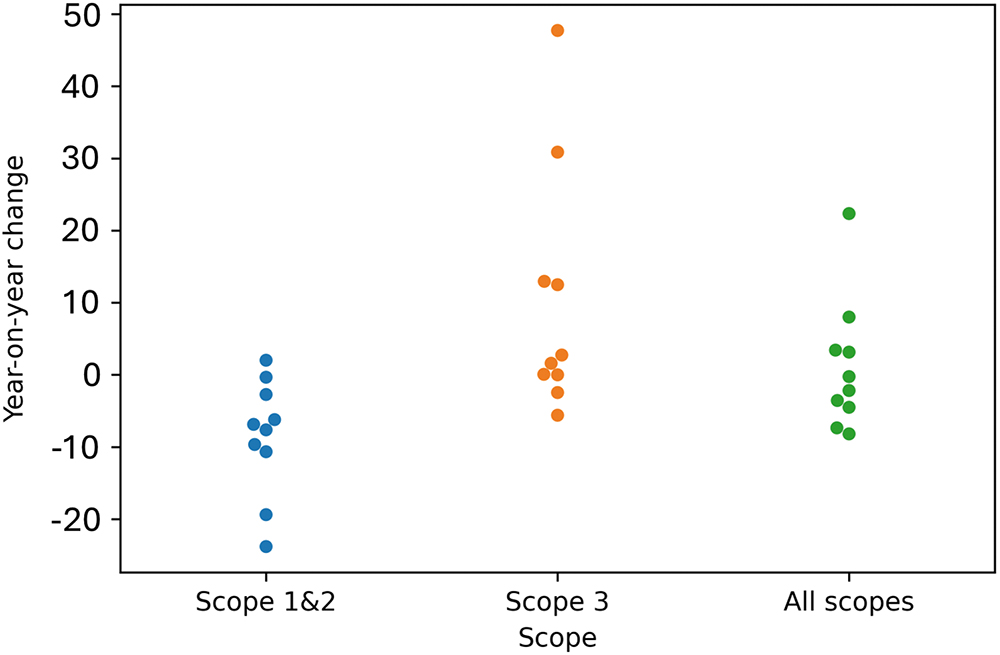

As noted in 2022, emissions are still not yet falling fast enough – in fact, the average year-on-year change in emissions across all scopes was a 2.5% increase in the latest reports.

“Although the large increases look like a step backwards, they are in fact positive progress. Now these emissions have been identified and recorded, they can be included in emissions-reducing efforts.”

Scope 1 and 2 emissions decreased for nine of the 10 companies, with an average reduction of 8.5% and a maximum reported reduction of 24%. The lone increase was 2% greater than the previous year’s emissions.

On average, Scope 3 emissions saw a 5.1% year-on-year increase, but this change varied from reported increases of 48% to reported reductions of 7%. There is a slight nuance; over recent years, the reach and accuracy of reporting has improved to meet legislative requirements, such as the Corporate Sustainability Reporting Directive and the German Supply Chain Due Diligence Act, and consumer expectations. Reported Scope 3 emissions have increased as reporting expands to include previously under-reported emissions. More recent reporting on 2023 emissions, which is not yet complete for all 10 companies but is less affected by this trend, varies from an increase of 9% to a decrease of 7% in Scope 3 emissions. Only five of the 10 companies reported a decrease in Scope 3 emissions in their most recent reports.

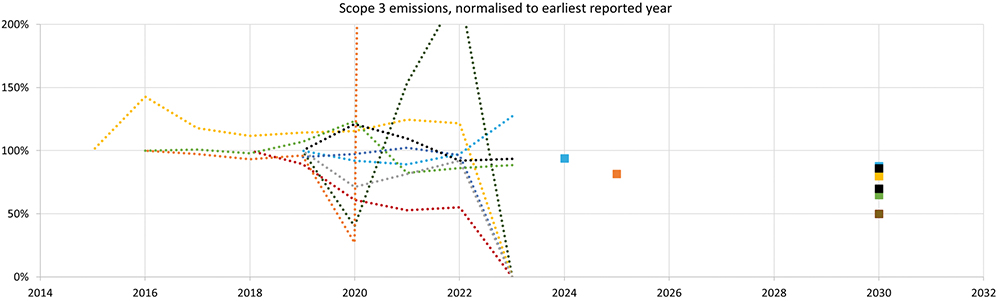

There was large variation in the year-on-year change in all-scope emissions, from an increase of 22% to a reduction of 11%. Scope 3 emissions dominated these increases, as Scope 3 emissions make up between 80% and 90% of total emissions; most companies did report a decrease in their Scope 1 and 2 emissions. As shown in Figure 2, companies’ performance in Scope 3, and therefore overall, varies widely.

Figure 2: Scope 3 emissions for 10 pharmaceutical companies, normalised to the first reported year, shown as dotted lines, and targets up to 2030, shown as squares. The colours each indicate a particular company.

Although the large increases look like a step backwards, they are in fact positive progress. Now these emissions have been identified and recorded, they can be included in emissions-reducing efforts.

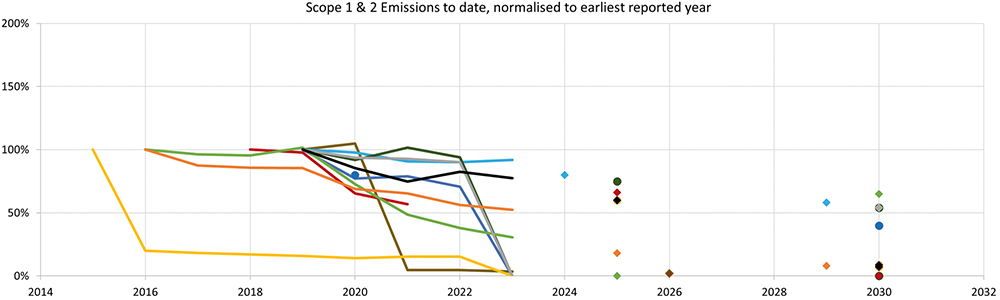

Of the 20 Scope 3 targets that were considered across the 10 companies, four were on track. One company, Bayer, has already met its smallest target – a 6% reduction in Scope 3 emissions, but the remaining 19 Scope 3 targets have not yet been reached (Figures 3 & 4).

Figure 3: The year-on-year change in greenhouse gases for 10 pharmaceutical companies. The change in emissions is shown as the percentage change between the 2 most recent years for which data is available, measured in CO2e.

Considering Scopes 1 and 2, again, some early, smaller targets have been met, such as Johnson & Johnson’s aim to reduce their Scope 1 and 2 emissions by 20% between 2015 and 2020. Beyond this specific case, of the 28 targets found, 10 were on track to meet their deadlines, of which three had met their goals early.

Figure 4: Scope 1 and 2 emissions for 10 pharmaceutical companies, normalised to the first reported year, shown as solid lines, and targets up to 2030, shown as diamonds. The colours each indicate a particular company.

“Another emerging trend is measuring the carbon or energy intensity of revenue or profits.”

But what about the IPCC and UN’s global targets? Reaching Net Zero by 2050 requires reducing emissions by approximately 4% of current emissions every year from 2023. Further work will then be required to achieve net negative emissions from 2050 onwards. Given the annual reductions and efforts discussed above, this does seem feasible. A total of six of the 10 companies examined committed to Scope 3 targets broadly equivalent to Net Zero by 2050, and a further three had committed to Net Zero in their Scope 1 and 2 emissions by 2050.7 Some of these targets are more ambitious than the IPCC’s suggested Net Zero by 2050. Of the more specific targets given, most are short term, and do not reach zero or near-zero emissions. These smaller reductions in emissions are positive, but are not enough to reach Net Zero by 2050 on their own.

These 10 companies are averaging a 0.5% decrease in their total footprints, but only five have reported reductions in their total footprint, and there is significant variation. Although current efforts are falling short, an annual reduction of 4% of current emissions does seem feasible.

The use of power purchasing agreements (PPA) in initiatives such as RE100 and Energize to provide renewable energy supplies for pharmaceutical companies’ suppliers continue to come online, such as Bayer’s PPA with Omega Energia – a 1.87 GW renewable energy generator coming online in 20248 – or Merck’s PPA with the Azure Sky project, matching 65% of Merck’s US energy consumption.9 Of the 10 companies, seven had made the RE100 pledge by September 2022, with deadlines ranging from 2025 to 2030.10 The RE100 initiative is a pledge to use only renewable electricity supplies by a certain deadline. At the time of writing, no more companies have made this pledge, but AstraZeneca has brought its target forward by five years to 2025.

There is progress being made. Companies are increasingly putting their money behind these promises; for example, AstraZeneca spent US$26.6 million (£20.6 million) in 2022 and US$33.7 million in 2023 on environmental efficiency projects.

“If all the current pMDIs in the NHS were to switch to new propellants, such as HFA-152a, the total NHS footprint could be reduced by approximately 2.7%.”

Another emerging trend is measuring the carbon or energy intensity of revenue or profits. This metric, using units such as kg CO2eq/USD or kWh/EUR, allows companies to decouple financial growth from increasing emissions. Reducing this value would show that companies can reduce their emissions without reducing economic success. Bayer is introducing an internal carbon price and Merck is developing its Sustainable Business Value method, allowing it to put a monetary value on environmental benefits. Pfizer factors in key performance indicators, which include climate goals, when calculating compensation for some of its staff.

These are concrete steps towards better, more environmentally sustainable decision making at the local and strategic levels. Multiple companies are redeveloping their current products and logistics to reduce environmental impact. AstraZeneca and GSK have both committed to developing improved next-generation versions of their current pressurised metered dose inhalers (pMDIs), transitioning to much lower global warming potential propellants.11,12 This will reduce the emissions associated with the use of these inhalers by as much as 99%, and the Scope 3 emissions of AstraZeneca and GSK by 41% and 15%, respectively. The process, which is well underway, will require extensive safety testing and a thorough redesign of the inhaler to accommodate the new propellant.

Koura and Honeywell (NC, US) are both developing new propellants, HFA-152a and HFO-1234ze, ready for this new market. Compared with the current propellants, such as HFA-132 and HFA 227ea, these propellants would lower the carbon footprint of a single dose by 90%–99%. This is a significant reduction as inhalers, predominantly the currently used propellants in them, account for 3% of the entire UK NHS carbon footprint.13 If all the current pMDIs in the NHS were to switch to new propellants, such as HFA-152a, the total NHS footprint could be reduced by approximately 2.7%. AstraZeneca aims to have its new inhaler ready for market launch in 2025 and says it is “on plan” to meet this goal, with HFO-1234ze in Phase II trials, as of 2022.

Sandoz has also recently redesigned the packaging and case for its longstanding Omnitrope Surepal (somatropin) therapy. Lifecycle assessments and human factors studies were used in combination to develop a new design that, beyond the environmental benefits of a lower-impact design, was also more user-friendly.

Pfizer has also significantly lowered its Scope 3 transport emissions by transitioning suitable product shipments from air to ocean in 2022. This saved approximately 50 Gt of CO2(eq), or around 6% of their reported Scope 3 emissions.

In conclusion, although progress overall continues to be mixed, serious efforts are clearly being made by several major pharmaceutical companies. Some have managed to achieve a reduction in total emissions over the last year, and several have set reductions targets compatible with the IPCC’s 1.5°C pathway. The scope and accuracy of climate-related reporting has improved. We are beginning to see the impact of PPAs and improved transport efficiency. Multiple sustainability focused product redesigns are underway.

The IPCC and UN pathways show that there is clearly a lot more work to do, but accurate emissions reports provide a roadmap for the work ahead, and the pharmaceutical industry has begun moving towards Net Zero.

REFERENCES

- Eldridge C, Shah O, “Climate Change and the Pharmaceutical Industry: Too Little, Too Late?”. ONdrugDelivery, Issue 139 (Oct/Nov 2022), pp 18–21.

- “Energy Explained”. National Grid, accessed Mar 2024.

- “AR6 Synthesis Report: Climate Change 2023”. IPCC, accessed Mar 2024.

- “For a livable climate: Net-zero commitments must be backed by credible action”. United Nations, accessed Mar 2024.

- “Ambitious corporate climate action”. Science Based Targets, accessed Mar 2024.

- References available upon request.

- References available upon request.

- “Bayer signs wind, solar PPA with Brazil’s Omega Energia”. Renewables Now, May 27, 2021.

- “Merck Brings New Renewable Energy to the Grid through Virtual Power Purchase Agreement with Enel Green Power”. Press Release, Merck, Mar 16, 2021.

- “RE100 Members”. Web Page, RE100. (https://www.there100.org/re100-members, accessed March 22, 2024)

- “GSK announces major step towards sustainability ambitions with advancement of low carbon Ventolin programme to Phase III trials”. Press Release, GSK, Nov 21, 2023.

- “AstraZeneca progresses Ambition Zero Carbon programme with Honeywell partnership to develop next-generation respiratory inhalers”. Press Release, AstraZeneca, Feb 22, 2022.

- “Blog: Delivering high quality, low carbon respiratory care”. UK NHS, Feb 13, 2023.